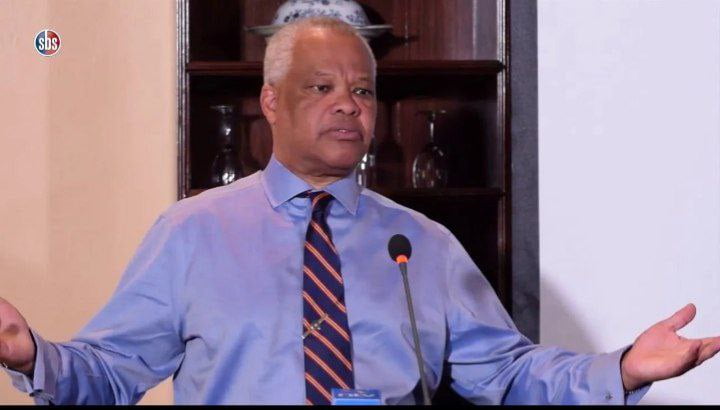

Raphael Tuju’s woes are brought about what I covered on this blog back in 2017.

The selective amnesia of the Kenyan Githeri media cannot be left to go on. In the case of Jubilee Secretary-general and East African Development Bank (EADB) bank over the loan of Ksh1.5 billion advanced to the former, this is the plain truth.

Raphael Tuju woes begin because at some point he was a lover to the Director-General of EADB Ms Vivienne Yeda Apopo and they used to enjoy steamy moments in her office and elsewhere.

The loan of Ksh1.5 million was advanced to Mr Tuju because he was close to the DG of EADB for the construction of two-storey bungalows sitting on a 20-acre forested land dubbed Entim Sidai.

The former Rarieda MP purchased a piece of property from a Scottish missionary Dr Albert Patterson for the construction of the above mentioned said to cost over Ksh100 million.

The default in paying the loans was occasioned by the slow progress of works on the property and by Tuju, having been a presidential advisor and now out in the political cold couldn’t get his hands on any coffers to loot so as to pay the money.

Tuju had used his bedroom skills to get into the head of Ms Apopo and walked away with Ksh1.5 billion.

The Bank is a house of scam where banking codes and professional conduct comes second to the open greed and lust for material wealth.

Staff are a corrupt lot let by the head Ms Apopo herself.

The Rot

Ms. Apopo together with the suspended National Treasury Permanent Secretary Kamau Thugge formed a very efficient cartel which carted money from the financial institution through dubious contracts and forged documents.

Honest staff at the bank raised issues with the manner in which things were being carried out without good governance, and integrity.

Ms Apopo who still manages the bank, thanks to her powerful boyfriends, used to give false financial reports about the bank’s profit. I doubt she has stopped.

For example, in a report prepared by Knight Frank Property firm on the bank’s valuation of its properties in Uganda, Kenya and Tanzania, Ms Apopo changed large sections of the report because it showed losses in especially Tanzania.

“The report had presented values indicating a loss in value of some of the properties in Tanzania. This would have meant that she reports a lower profit. She then hired another firm in Tanzania called African Properties, who they influenced to give a higher value of the property in Tanzania which was not in line with fair market value’, said a statement from a source within the bank.

To make matters worse, she picked the inflated valuation figures from African Properties Ltd report for the Tanzania bank assets and inserted those figures into the Knight Frank report which was then presented to the external auditors for inclusion in their audit report.

Because she always manipulates the property valuation figures to help her lie to the public and yourselves that the bank is making profits. This is criminal. She should never have misrepresented the Knight Frank report by inserting inflated figures from a report by African Properties Ltd.

Back to the tussle over the Ksh1.5 billion loan with Tuju, the supervision of the bank is compromised. Just like the way Kenyan commercial banks can play with illicit cash, and make-up applying CBK Governor Patrick Njoroge looks the other way, is the same way the board which comprises of politicians handles EADB and Ms Apopo.

The governing council is comprised of Kenya’s acting Treasury CS Ukur Yattani, Uganda’s Matia Kasaija, Tanzania’s Philip Mpando and Rwanda’s Ndagijimana Uziel.

The Board of Directors is comprised of Uganda’s Finance PS Keith Muhakanizi, J Tumisiime from Uganda, Kenya’s Treasury PS Dr Julius Muia, Francis Karuiru from Kenya, Rwanda’s Finance PS Caleb Rwamuganza, Faustine Mbundu from Rwanda, Tanzania’s Finance PS Doto James and Mrs Simba also from Tanzania.

It appears the law has finally caught up with the crooks and the law must look at both sides. The bank’s management led by Ms. Apopo must also be held to account for illegal business behaviours.

On Tuesday Judge Wilfrida Okwany gave a go-ahead for the ban to recover the loan from the hotel linked to SG Tuju. This verdict was in line with what a judge in the United Kingdom had ordered in June 19 2019.

The appeal by Tuju was dismissed and therefore Dari Limited (Tuju’s firm) and four other people are to pay the loan.

MORE:

- EADB E&Y AUDIT : How EADB’s Vivienne Yeda Apopo Has Been Looting The Regional Bank

- Another Waiguru? Meet Vivienne Yeda Apopo, Crook EADB Boss & Reason Women Shouldn’t Be Allowed To Head Institutions.

- Impunity : Besieged EADB Crook Boss Vivienne Apopo Issues death threats to Staff