Saccos are savings and credit cooperative societies that offer various financial services to their members, such as savings, loans, dividends, and investment opportunities.

Saccos are popular in Kenya because they provide affordable and accessible credit, promote a culture of saving, and empower their members economically.

However, not all Saccos are created equal. Some Saccos are more reliable, profitable, and reputable than others.

How do you choose and join the best Saccos in Kenya?

What are the benefits of joining a Sacco in Kenya?

Joining a Sacco in Kenya can offer you several benefits, such as:

- Saving money regularly and earning interest on your deposits

- Accessing low-interest loans for personal or business needs

- Sharing profits and earning dividends on your share capital

- Investing in various projects and assets that generate income

- Enjoying financial education and advice from experts

- Networking and socializing with other members who share common goals and interests

- Participating in the management and decision-making of the Sacco

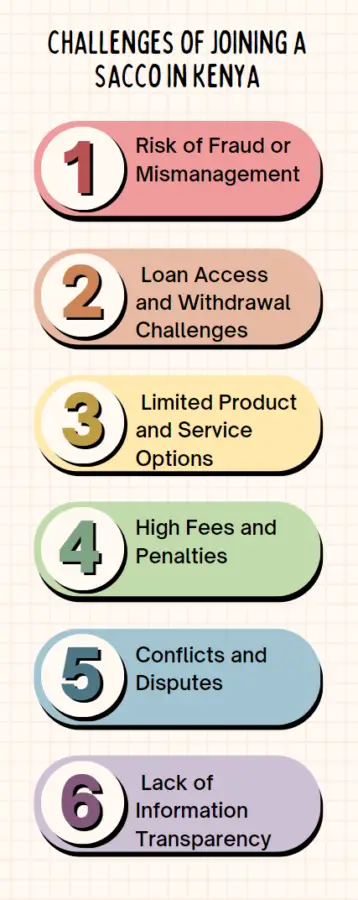

What are the challenges of joining a Sacco in Kenya?

Joining a Sacco in Kenya can also pose some challenges, such as:

- Losing your money to fraudsters or mismanagement

- Facing delays or difficulties in accessing loans or withdrawing savings

- Having limited options or flexibility in choosing products or services

- Paying high fees or penalties for late payments or defaults

- Dealing with conflicts or disputes among members or leaders

- Having insufficient information or transparency on the performance or operations of the Sacco

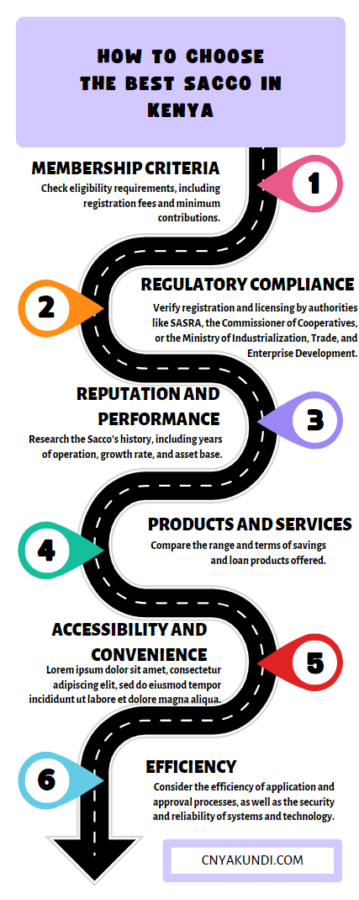

How do you choose the best Sacco in Kenya?

Choosing the best Sacco in Kenya can be a daunting task, given the many options available. However, you can use some criteria to narrow down your choices and select the most suitable one for you. Some of the criteria are:

- Membership: You should check the eligibility and requirements for joining a Sacco, such as the registration fee, minimum monthly contribution, share capital, and identity documents. You should also consider the size and diversity of the membership, as well as the common bond or affiliation that unites them.

- Regulation: You should verify that the Sacco is registered and licensed by the relevant authorities, such as the Kenya Sacco Societies Regulatory Authority (SASRA), the Commissioner of Cooperatives, or the Ministry of Industrialization, Trade, and Enterprise Development. You should also check the compliance and governance standards of the Sacco, such as the audited financial statements, annual reports, and code of conduct.

- Reputation: You should research the history and performance of the Sacco, such as the years of operation, growth rate, asset base, loan portfolio, dividend payout, and customer satisfaction. You should also seek recommendations and reviews from other members, experts, or media outlets.

- Products and services: You should compare the products and services offered by the Sacco, such as the types, terms, and rates of savings and loans, the investment opportunities and returns, the insurance and welfare schemes, and the value-added services, such as mobile banking, ATM cards, or cheque books.

- Accessibility and convenience: You should assess the accessibility and convenience of the Sacco, such as the location and opening hours of the branches and offices, the availability and quality of the customer service and support, the ease and speed of the application and approval processes, and the security and reliability of the systems and technology.

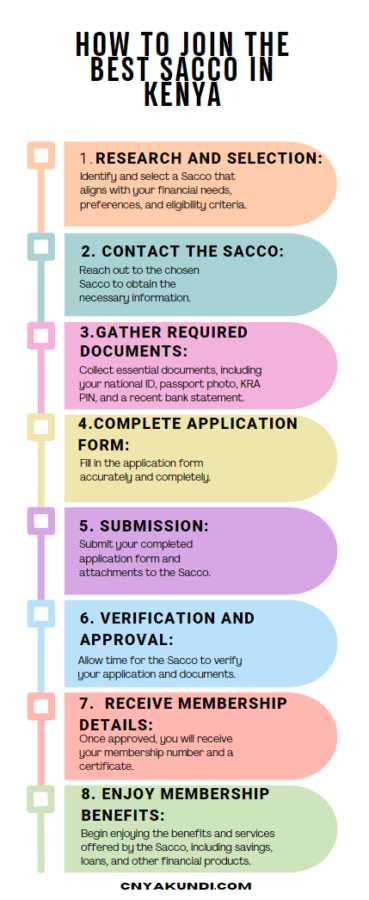

How do you join the best Sacco in Kenya?

Joining the best Sacco in Kenya can be a simple and straightforward process, if you follow these steps:

- Identify and select the Sacco that meets your needs and preferences, based on the criteria discussed above.

- Contact the Sacco and obtain the application form and the list of required documents, such as your national ID, passport photo, KRA PIN, and bank statement.

- Fill in the application form and attach the required documents, along with the registration fee and the initial deposit or share capital.

- Submit the application form and the attachments to the Sacco, either in person or online, and wait for the verification and approval.

- Receive your membership number and certificate, and start enjoying the benefits of the Sacco.

What are the best Saccos in Kenya?

Here are the top 10 best Saccos in Kenya, in no particular order:

- Mwalimu Sacco: This is the largest Sacco in Kenya, with over 100,000 members from the teaching profession. It offers various products and services, such as savings, loans, dividends, insurance, and education. It has a dividend rate of 12.5% and an interest rate of 11% on deposits.

- Stima Sacco: This is a leading Sacco in Kenya, with over 80,000 members from the energy sector and other fields. It offers various products and services, such as savings, loans, dividends, investment, and mobile banking. It has a dividend rate of 14% and an interest rate of 13% on deposits.

- Mhasibu Sacco: This is a reputable Sacco in Kenya, with over 40,000 members from the accounting profession and other sectors. It offers various products and services, such as savings, loans, dividends, insurance, and financial literacy. It has a dividend rate of 15% and an interest rate of 10% on deposits.

- Waumini Sacco: This is a faith-based Sacco in Kenya, with over 30,000 members from the Catholic Church and other denominations. It offers various products and services, such as savings, loans, dividends, insurance, and welfare. It has a dividend rate of 16% and an interest rate of 9% on deposits.

- Kimisitu Sacco: This is a well-established Sacco in Kenya, with over 20,000 members from the non-governmental organizations and other sectors. It offers various products and services, such as savings, loans, dividends, investment, and credit cards. It has a dividend rate of 15% and an interest rate of 9% on deposits.

- Safaricom Sacco: This is a dynamic Sacco in Kenya, with over 15,000 members from the telecommunication sector and other fields. It offers various products and services, such as savings, loans, dividends, insurance, and e-commerce. It has a dividend rate of 14% and an interest rate of 10% on deposits.

- Harambee Sacco: This is a historic Sacco in Kenya, with over 70,000 members from the public service and other sectors. It offers various products and services, such as savings, loans, dividends, insurance, and diaspora banking. It has a dividend rate of 12% and an interest rate of 10% on deposits.

- Unaitas Sacco: This is a fast-growing Sacco in Kenya, with over 300,000 members from the agricultural sector and other fields. It offers various products and services, such as savings, loans, dividends, insurance, and agribusiness. It has a dividend rate of 12% and an interest rate of 10% on deposits.

- Kenya Police Sacco: This is a reliable Sacco in Kenya, with over 60,000 members from the security sector and other professions. It offers various products and services, such as savings, loans, dividends, insurance, and asset financing. It has a dividend rate of 17% and an interest rate of 10.8% on deposits.

- Hazina Sacco: This is a progressive Sacco in Kenya, with over 15,000 members from the trade union and other sectors. It offers various products and services, such as savings, loans, dividends, insurance, and land banking. It has a dividend rate of 18% and an interest rate of 10.6% on deposits.

ALSO READ

- Bobbi Althoff Parents: Age, Net Worth, Husband, Kids

- Tina Majorino Age, Height, Net Worth, Movies and More

- Rudy Pankow Age, Height, Net Worth, Instagram, Girlfriend

- Adin Ross Sister, Age, Height, Net Worth, Girlfriend

- Colter Wall Age, Height, Net Worth, Ranch, Tour

Conclusion

Saccos are savings and credit cooperative societies that offer various financial services to their members, such as savings, loans, dividends, and investment opportunities.

Saccos are popular in Kenya because they provide affordable and accessible credit, promote a culture of saving, and empower their members economically. However, not all Saccos are created equal.

Some Saccos are more reliable, profitable, and reputable than others.

To choose and join the best Saccos in Kenya, you need to consider the membership, regulation, reputation, products and services, and accessibility and convenience of the Saccos.

You also need to follow the application and approval process of the Sacco.