A concern raised by CBK regarding the regulation of KUSCCO’s deposit-taking business, following a complaint by a concerned SACCO leader, has initiated a multi-billion fraud investigation against KUSCCO.

On March 22, 2022, the former no-nonsense Governor of CBK, Dr. Patrick Njoroge, wrote to the SASRA CEO and the then PS Cooperatives, alerting them to the magnitude of the risk posed by KUSCCO’s continued deposit-taking business from regulated and unregulated SACCOs.

In the letter, Dr. Njoroge expressed concerns about how an entity holding close to Ksh 20 billion from SACCOs was not under the regulator’s purview.

The Governor, known for his straightforward approach and emphasis on compliance in the financial sector, directed SASRA to conduct a review and establish the necessary regulatory framework for KUSCCO’s deposit-taking business.

Loading...

Loading...Our sources report that the CEO of KUSCCO, Mr. George Ototo, vehemently opposed the regulation of KUSCCO’s deposit-taking despite the obvious risks.

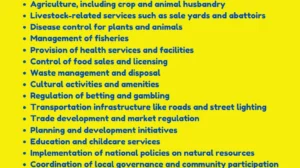

As a follow-up to Dr. Njoroge’s letter, the current administration, through the CS of Cooperatives and MSMEs, Mr. Simon Chelugui, directed SASRA to conduct an inspection of KUSCCO and report on whether the continued deposit-taking business is legal and if any offenses have been committed.

They were also instructed to apply the necessary mechanisms to regulate the business.

After a one-month review, the preliminary findings of SASRA are both shocking and worrying for the sector.

There are glaring discrepancies between the deposits collected from SACCOs, the loans advanced, and the available funds.

Our sources report that about Ksh 8 billion cannot be accounted for.

Major SACCOs have deposits in KUSCCO, with some SACCOs having over Ksh 900 million placed in KUSCCO.

Investigations are ongoing, linking several SACCO leaders to have benefited from commissions and incentives for placing deposits in KUSCCO.

This has caused panic in the sector, with several CEOs and boards siding with KUSCCO and opposing the investigations.

However, it is worth noting that the members’ funds are at risk if the forensic audit or investigations are not completed to establish the whereabouts of Ksh 8 billion.

Once KUSCCO learned that the preliminary report incriminated some of their activities and actions, they rushed to court and obtained restraining orders against SASRA.

How this has been allowed to happen has puzzled everyone in the sector.

The only available option now is for the Commissioner of Cooperatives to send an inquiry team to KUSSCO to unearth the decade-old malpractices at the institution.

It is worth noting that Kenya has just been ranked ‘Poor’ by the World Bank & IMF on the Anti-money Laundering Framework and Policies.

The lack and failure of oversight of a key institution that has about Ksh 20 billion in deposits complicate Kenya’s efforts in regulating and enforcing compliance in the financial sectors.

KUSCCO management has gone all out with massive campaigns and propaganda to tarnish the government’s efforts to strengthen the SACCO subsector.

The big question is: Are members’ hard-earned savings in their respective SACCOs safe?

Amidst all this, KUSCCO has organized regional forums to discredit the ongoing inspection.

They have mobilized SACCO leaders to attend a forum in Mombasa in early December 2023 to continue with the incitement. Who will save the sector from the imminent risk of massive loss of funds and fraud?

Our sources have indicated that in the next few days, a detailed list of all the SACCOs that have placed huge deposits will be released to the public.

It is important to note that KUSCCO does not have funds to honor the maturing deposits and has, for a long time, been rolling over the funds with higher interests.

Currently, the DCI and the EACC have been invited to commence criminal investigations against the management team and other leaders who have been part of risking the members’ funds.

The days ahead may be turbulent for the embattled KUSCCO CEO and his management, but also painful decisions will have to be made to restore confidence in the SACCO subsector.