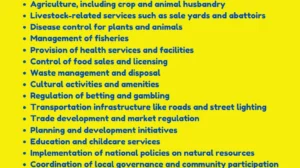

The National Hospital Insurance Fund (NHIF) is a state agency that provides health insurance to Kenyans.

It covers various medical expenses, such as consultations, prescriptions, surgeries, and hospitalizations.

However, the NHIF rates are set to change in 2024, and this will have a significant impact on your pocket and your health.

In this article, we will explain the new NHIF rates, why they are changing, and how they will affect you.

The New NHIF Contribution Structure

The new NHIF contribution structure is based on a standard rate of 2.75% of the gross monthly income.

This means that the amount you pay will depend on how much you earn, whether you are employed or self-employed.

Here is a summary of the new NHIF rates for different income groups:

- For salaried employees, the contribution will be 2.75% of the gross monthly salary, deducted and remitted by the employer. For example, if you earn Ksh 50,000 per month, you will pay Ksh 1,375 to NHIF.

- For self-employed and informal sector workers, the contribution will be 2.75% of the declared or assessed gross monthly income, subject to a minimum of Ksh 300. For example, if you earn Ksh 20,000 per month, you will pay Ksh 550 to NHIF.

- For retirees and other exempt groups, the contribution will be a flat rate of Ksh 300 per month.

The new NHIF rates will take effect in October 2024 and will be reviewed every three years.

The Reasons for the New NHIF Rates

The new NHIF rates are part of the government’s plan to achieve universal health coverage (UHC) in Kenya.

UHC means that everyone can access quality and affordable health services without facing financial hardship. The new NHIF rates are meant to:

- Increase the revenue of NHIF, which has been facing financial challenges due to rising health costs, fraud, and low compliance.

- Expand the coverage of NHIF, which currently covers only 40% of the population, leaving many people uninsured or underinsured.

- Improve the benefits of NHIF, which currently have limitations and exclusions, such as waiting periods, co-payments, and caps.

- Enhance the equity of NHIF, which currently has a regressive and unfair contribution structure, where low-income earners pay more than high-income earners.

The new NHIF rates are expected to generate an additional Ksh 30 billion per year, which will be used to improve the quality and accessibility of health services in Kenya.

The Implications of the New NHIF Rates

The new NHIF rates will have various implications for you, depending on your income and health status. Here are some of the possible effects of the new NHIF rates:

- For low-income earners, the new NHIF rates will reduce the financial burden of health care, as they will pay less than before. They will also enjoy more benefits, such as outpatient services, maternity care, and chronic disease management.

- For high-income earners, the new NHIF rates will increase the financial cost of health care, as they will pay more than before. They will also face more competition, as more people will access the same health facilities and services.

- For self-employed and informal sector workers, the new NHIF rates will require more compliance and accountability, as they will have to declare and verify their income. They will also have to pay more, as the minimum contribution will increase from Ksh 500 to Ksh 300.

- For retirees and other exempt groups, the new NHIF rates will not affect them much, as they will continue to pay a flat rate of Ksh 300. However, they may benefit from the improved health system and services.

The new NHIF rates are a major change in the health sector, and they will affect everyone in one way or another.

Therefore, it is important to be informed and prepared for the new NHIF rates, and to make the best use of the NHIF benefits.

ALSO READ

- Bobbi Althoff Parents: Age, Net Worth, Husband, Kids

- Tina Majorino Age, Height, Net Worth, Movies and More

- Rudy Pankow Age, Height, Net Worth, Instagram, Girlfriend

- Adin Ross Sister, Age, Height, Net Worth, Girlfriend

- Colter Wall Age, Height, Net Worth, Ranch, Tour

FAQs

What are the new NHIF contribution rates for formal employees?

The new NHIF rates for formal employees are based on a 2.75% flat rate of their gross monthly salary. This replaces the previous tiered system based on individual salary bands.

What are the new NHIF contribution rates for informal employees?

The new NHIF contribution rate for informal employees remains at Ksh 500 per month or Ksh 6,000 per year.

How will the new rates affect informal employees?

The contributions remain the same for informal employees, so there will be no immediate change in their financial burden.

Do these changes affect government contributions for vulnerable groups?

The government will continue to cover NHIF contributions for vulnerable groups, including children under 5, orphans, and the elderly above 65.

What are the benefits of these changes?

The government aims to achieve universal health coverage (UHC) in Kenya through these changes. The flat rate for formal employees aims to make NHIF more equitable and ensure everyone contributes based on their ability to pay. Additionally, the continued government support for vulnerable groups ensures they can access health care without financial barriers.

Are there any concerns about the new rates?

Some concerns have been raised about the increased burden on higher-income earners under the new system. Additionally, there are questions about the sustainability of the UHC plan and the government’s ability to adequately fund healthcare services for all Kenyans.

How can I contribute to the UHC plan?

In addition to paying your NHIF contributions, you can also support the UHC plan by:

- Choosing NHIF-accredited healthcare providers when seeking medical care.

- Advocating for improved healthcare services in your community.

- Promoting healthy living practices and disease prevention.

What is the future of NHIF and UHC in Kenya?

The success of the new NHIF rates and the UHC plan will depend on continued government commitment, financial sustainability, and public engagement. By working together, Kenyans can build a stronger and more equitable healthcare system that benefits everyone.