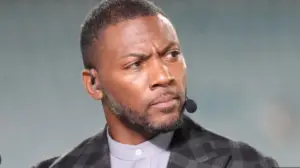

Caption: St. Paul’s Property Trust officials during the presentation held at Sankara and hosted by AlyKhan Satchu who nobody seems to trust.

We have always felt that AlyKhan Satchu is a white-collar conman using his fake British accent to propel himself to our local set-up of low self-esteemed media operatives. We think he appears on the media unnecessarily and know that every major business operative that has bribed business journalists for favourable continuous coverage, always ends up as a crook.

Memories of Evans Kidero, Jonathan Ciano, Chris Kirubi, Titus Naikuni, Munir Sheikh and now Kenya Airways CEO Mbuvi Ngunze are very fresh in our minds. Why do these people bribe journalists? What are these pressing issues that they want Kenyans to know everyday? Don’t they have public relations officers?

We are now asking anyone with corruption information against Kenya Airways and Mbuvi Ngunze whom we hear is a million times more of a thief than Titus Naikuni, to send us information at [email protected]

Read the following story and see first-hand how Kenyans are ripped off by smooth-talking British accented crooks like AlyKhan Satchu.

Hi Nyakundi.

(Please ensure confidentiality).

I am a trader with interests in commodities and equities. I am writing this to point a number of issues about a company known as St Paul’s Property Trust (henceforth known as SPPT).

In November last year, Kenyan media reported that SPPT, a UK based firm intended to list at the NSE seeking to raise sh 5 billion. The said listing never happened which was blamed on the currency headwinds.

A few weeks ago, the managers were back in Nairobi. They had a forum that was hosted by Aly Khan Satchu at Sankara hotel. I attended the forum. Their transaction manager is Burbidge Capital (a Kenyan firm).

What I heard in the presentation sounded an alarm to me and to a number of people who raised similar questions.

Readers should first understand why companies list. They list to raise money from investors who believe that they will make money from the company. After a company lists, the investors becomes shareholders of the company.

For a company to list at the NSE (and in any bourse for that matter), the company must first deal with the regulators (in our case CMA) who will scrutinize the company. Investors buy stakes in companies that are in existent and those that are currently making money.

However, a close look at SPPT reveals a number of issues which I would like people to know.

*Start-up*

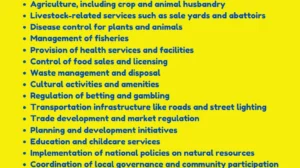

From what my research has established, SPPT is just a start-up and not a company that is not up and running. For starters, the model SPPT plans to use is pretty simple. They buy property and then lease it to government who becomes the tenant. The returns of this investment (according to the managers) will be 2% annually.

Unfortunately, the company does not have any property as at now. This is clear from the company’s website which states that:

*The St Paul’s portfolio will be comprised of long and short lease AAA-rated assets, outside of central London.

**(http://

<http://

The only property in their website is Norman’s house. They don’t claim to own it as at now

(http://

This means that the company does not currently exist and their plans will be to take money from Kenyans and then go to buy the said properties.

This is risky for ordinary investors. One of the principles of investing is that you should never invest in a start-up because the paper projections don’t always work.

If the company has cashflow, then it would be easy for investors to make their own projections.

Moreover, the company seeks to list sh 8 billion (approx. $80 million). In the financial capitals such as London, this money is peanuts. If the managers have the reputation they claim to have, they can easily get the funds within a week. (To understand how fundraising happens in the UK, I recommend the readers to get a book called Money Maverick: confessions of a hedge fund manager by Lars Kroijer).

*A Briefcase company*

Surprisingly, I believe that the company is a briefcase company. In their website, they claim that they are located at Merchants House, 24 North Quay, Douglas Isle of Man. IM1. Thanks to Google map, I have searched for said building and what I have seen does not seem to house a company raising $80 million. In fact, my theory is reinforced by this page (http://www.192.com/places/im/

The list of the management team also raises more questions than answers. I ask people to conduct a brief research about these people (

http://

Again, does this company have any employees? If so, how many?

Side note: A Google Search (St Pauls Property Trust) produces only Kenyan news pages. The international pages available are merely writeups from Kenyan media. The company’s website comes in the second page of Google.

*Conclusion*

SPPT has not yet received a greenlight from CMA to list at NSE. However, according to the management and Burbidge Capital, the firm will probably be listed in the second quarter. I ask the CMA to carefully scrutinize this company and make a decision that is with the interest of Kenyans.

I also ask Kenyans to be very careful when buying these shares. As a shareholder, you are entitled to any information about a company. Since the company does not have an office in Kenya, where will you get this information? Their website??

SPPT is promising Kenyans a 2% annual return. While their numbers are in Sterling Pounds, I believe that your money can be safe in other companies.

You can also put your money in fixed deposit accounts which will make you more than the 2% return you are promised. Remember that all companies that have debuted in the NSE in the last 2 years have cost investors dearly.

If SPPT is a genuine company, they would not be looking for investor money from the public market. There are many private equity companies and high net worth individuals in London who can offer them the money. NSE is for mature companies with cash-flow.

Finally, note that I am not advising any person against buying the company once it debuts, I am just asking you folks to analyse the company well. Know what you are buying and don’t follow the crowd.

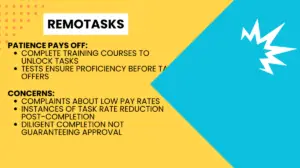

The presentation about the company at Sankara can be found down here