Life for Fuliza M-Pesa defaulters could get a tad bit difficult starting next month when new tough terms and conditions for the service officially take effect.

Safaricom has announced that starting November 14, 2021, the company will hold any of its customer’s remaining funds as collateral for defaulting their Fuliza loan.

According to their fresh consequences of default, “any time after an Event of Default has occurred which is continuing, KCB and NCBA may without prejudice to any other right or remedy granted to us under any law: hold any of your funds standing in credit with KCB or NCBA as collateral and security for any amounts outstanding and due from you in respect of the Facility or Service.”

Upon default, the customer will also be immediately terminated from accessing the service until the loan is settled.

“Any time after an Event of Default has occurred which is continuing, KCB and NCBA may without prejudice to any other right or remedy granted to us under any law: to terminate the Services in accordance with clause 23 below (and) declare that the Facility (inclusive all Interest, fees and charges) and all other amounts outstanding under these Terms and Conditions is immediately due and payable, whereupon you shall be required to settle the Facility with immediate effect,” reads the rest of the brief.

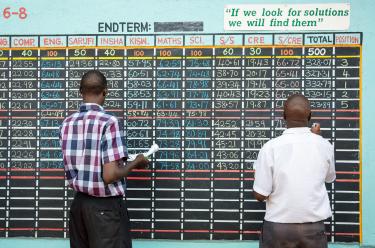

What is Fuliza?

Fuliza M-Pesa is an overdraft facility for all M-Pesa users which is provided under NCBA Bank.

The facility allows you to complete your M-Pesa transactions even when you have insufficient funds in your account.

Note that although people call it Fuliza loans, it is not a loan.

In essence, Fuliza M-Pesa is like a bank overdraft.