[ad_1]

What does this chart show?

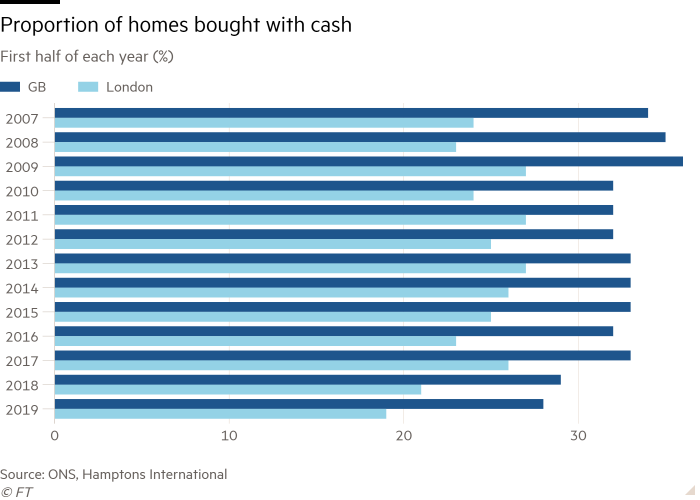

That the share of UK homes bought with cash fell to its lowest level since 2007.

During the first half of the year, the proportion of purchases made without a mortgage dropped to 28 per cent, 5 percentage points lower than over the same period in 2017. The figure marks a significant shift from 10 years ago, when 36 per cent of homes were bought without mortgages.

In the research from estate agent Hamptons International, the proportion of cash buyers fell in every region in the UK. The biggest decline was in the West Midlands, which saw a 9 per cent fall in the share of homes bought for cash in the first six months of 2019 compared with 2017.

This was closely followed by London, where the share of cash buyers dropped to 19 per cent from 26 per cent. Scotland saw the smallest recorded decrease with a fall of only 1 percentage point since 2017.

What’s behind this?

One factor is house prices. The latest HM Land Registry data found that the average cash purchase price in the first six months of 2019 was £217,810, a 1.4 per cent rise on the same period in 2017.

Aneisha Beveridge, head of research at Hamptons International, said the declining trend could also be explained by a falling number of downsizers.

She said: “The fall in cash purchases not only reflects tighter affordability but also a decrease in activity among downsizers, the group of people most likely to have built enough equity to purchase property with cash.”

However, although the number of homes bought with cash in London was down on last year, the cost of buying a home in London has fallen. The average cash purchase price in London was £489,820 at the start of 2019, down 3.6 per cent on the same period in 2017.

Who is most likely to buy homes in cash?

Most cash buyers wanted to live in the property they were buying — 7 per cent more than in 2009. Buy-to-let investors now make up a smaller number of this group than in previous years.

In 2009, 32 per cent of cash buyers bought to rent, but during the first six months of this year only 24 per cent did so. The type of property that cash buyers are more likely to buy is also evolving.

Buyers are purchasing smaller properties: the share of two-bedroom homes crept up from 32 per cent in the first half of 2017 to 34 per cent in 2019. The proportion of those buying four-bedroom homes for cash dropped from 18 to 16 per cent between 2017 and 2019.

Which regions buy the most homes with cash?

The South West is the region with the highest proportion of cash sales, with 34 per cent of homes sold purchased with cash in the first half of this year.

West Somerset came out on top in this region with more than half (58 per cent) of homes in the local authority bought with cash. Although this number is high, it has also seen a decrease (7 per cent) since the same period in 2017.

[ad_2]

Source link