SBM Bank, the successor to the collapsed Chase Bank has entered the dire straits.

Reports indicate the the bank which acquired both Chase and Fidelity commercial banks has tapped into the Sh10 billion loan from the industry regulator, Central Bank of Kenya (CBK).

The money is a liquidity support that’s often taken to keep struggling banks alive by injecting emergency funds.

Non – Performing Loans (NPLs) have eaten into the banks profits. The bank recorded an 83 per cent drop in after-tax profits during the first six months of the year to Sh98 million down from Sh585 million during a similar period in 2019.

The loan defaults means that out of Sh24 billion, about Sh17 billion worth of loans are phoney.

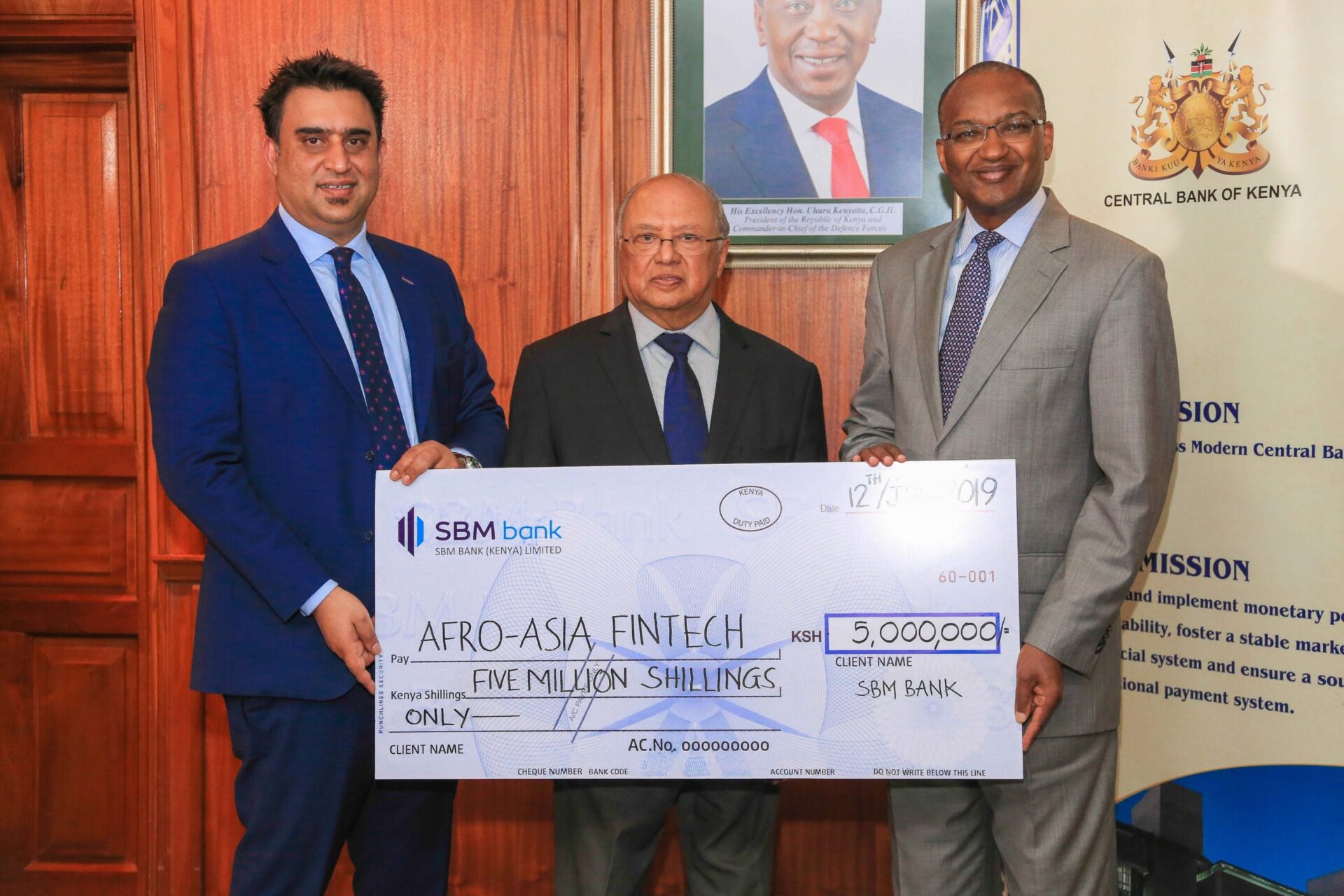

When SBM entered the Kenyan market it acquired Fidelity bank at Sh100 cash consideration (and Sh1.2 billion goodwill). It also took over Chase Bank’s at Sh500,000 cash consideration inheriting Sh70 billion assets, Sh67 billion liabilities, over 60 branches and over 1000 employees.

The COVID-19 pandemic has worsened the recovery of a bank that tried to salvage two from collapsing.

Meaning, SBM Bank has entered a struggling phase.