Equity bank is a bank of iniquity.

In Kenya, we’ve highlighted a lot of the corruption, money laundering and theft that goes on inside the walls of various Equity bank branches.

Today, we present to you a top-notch corruption scandal involving the bank’s Kilimani Branch.

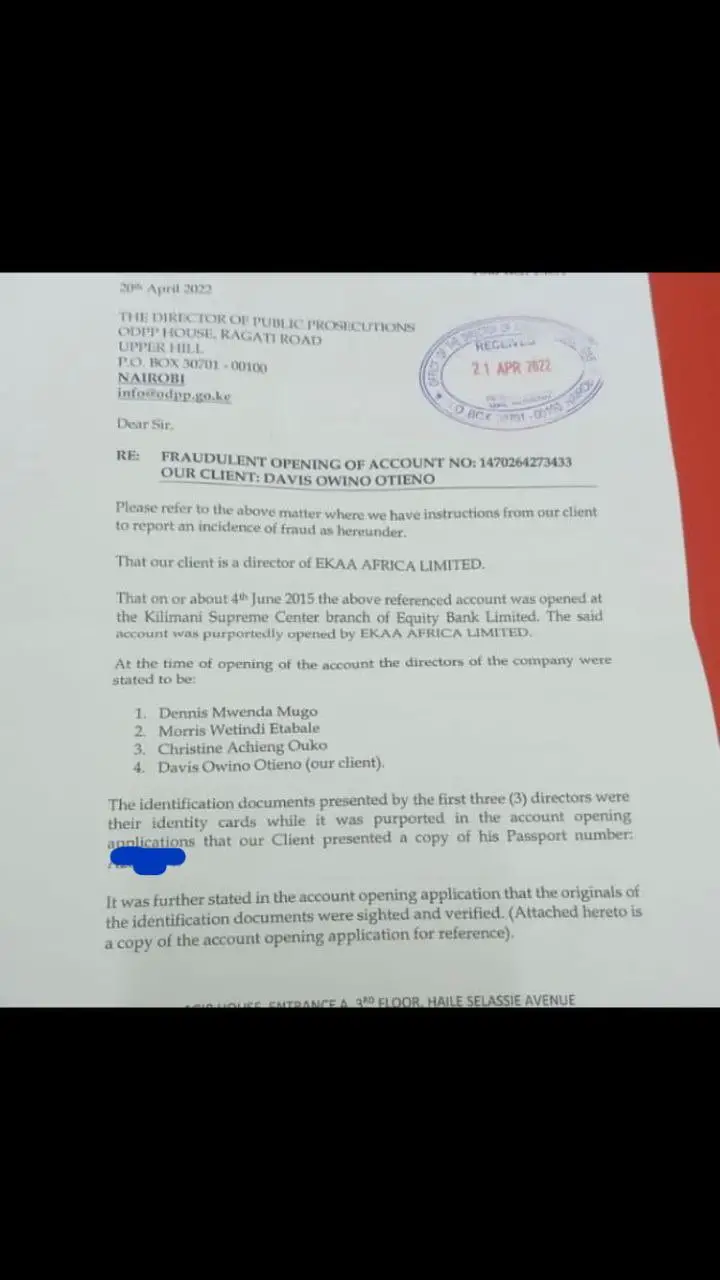

A client, a Mr David Owino Otieno had flown away from Kenya when his passport details were used to open an account.

I left the country on 21/4/2015 and came back on 04/9/2015. On 04/06/2015, Equity Bank staff, a branch manager Agrey Muriuki and Pamela Odawo, customer care manager got hold of my passport copy and open an account in my name – David Owino Otieno

Below is the chronology of events

My name is Davis Otieno Owino. I am a businessman, 2015 I was based in Asia, I was in china supervising the production of interactive screens.

in china, after we won a tender to supply the ministry of education, which was almost equivalent to 70 million shillings, I Davis own is one of the directors of Ekaa Africa company limited, won the tender.

We didn’t have enough money to procure the screens, so we approach James Stuart Smith, Chief executive at Utility Trading, to finance the project.

Utility Trading agreed to finance the project from China to Kenya.

We opened an escrow account with Utility, where money was supposed to be paid, that was the agreement with Utility.

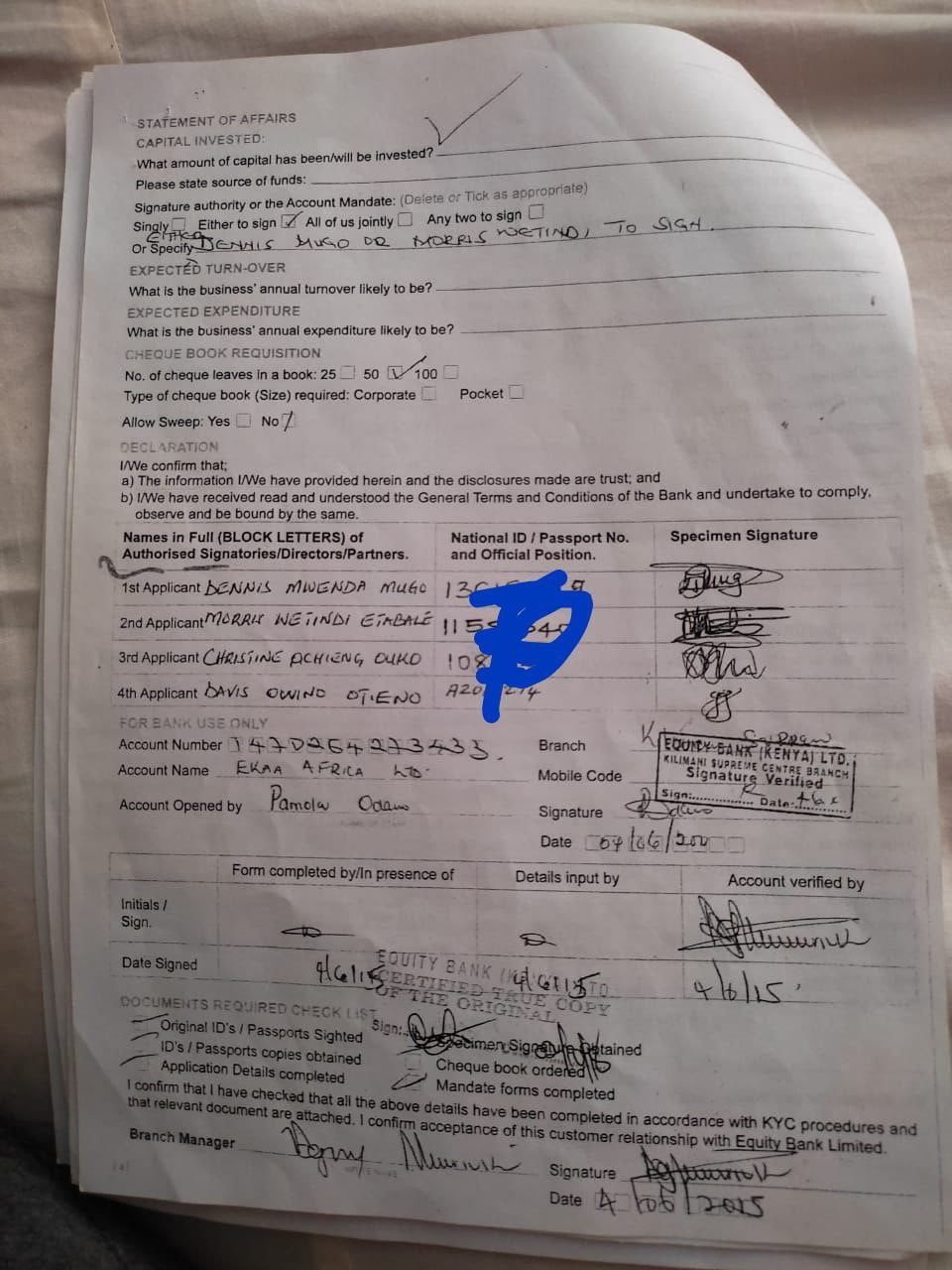

I left the country on 21/4/2015 to supervise production in China, I was not aware of the Equity account. The bank managers colluded with the other directors to scam James from Utility Trading. They knew very well, I will not accept. The account was opened by the branch manager at Kilimani supreme bank, together with the customer care manager Pamela Odawo.

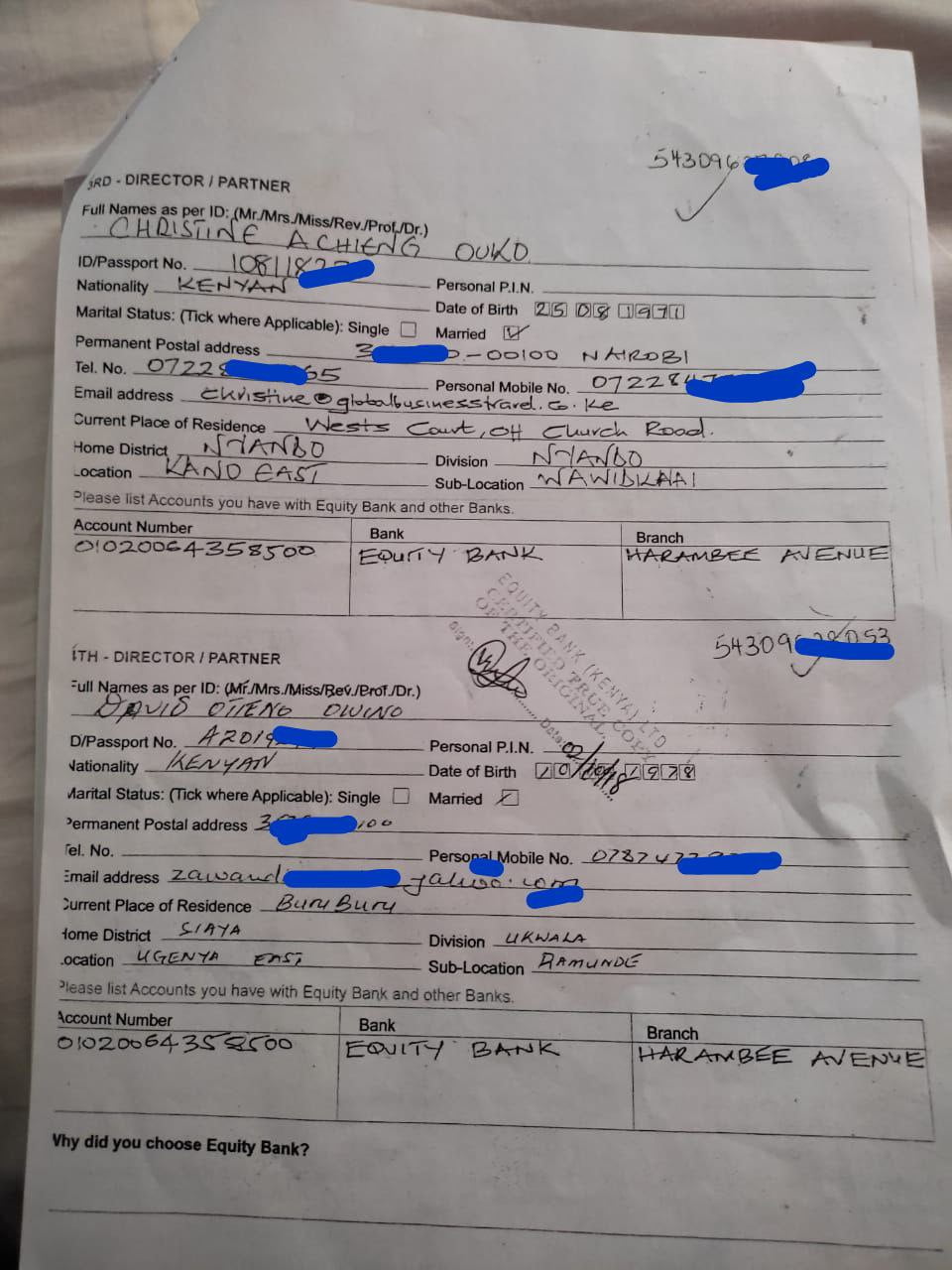

They forged my signature, used my passport copy, gave me a wrong date of birth, and gave me a wrong account that I operate at Equity, it was all forgery. Equity bank played a very big role in scamming me and James if they didn’t forge my document no way Money was going to be sent from the ministry of finance to Equity bank.

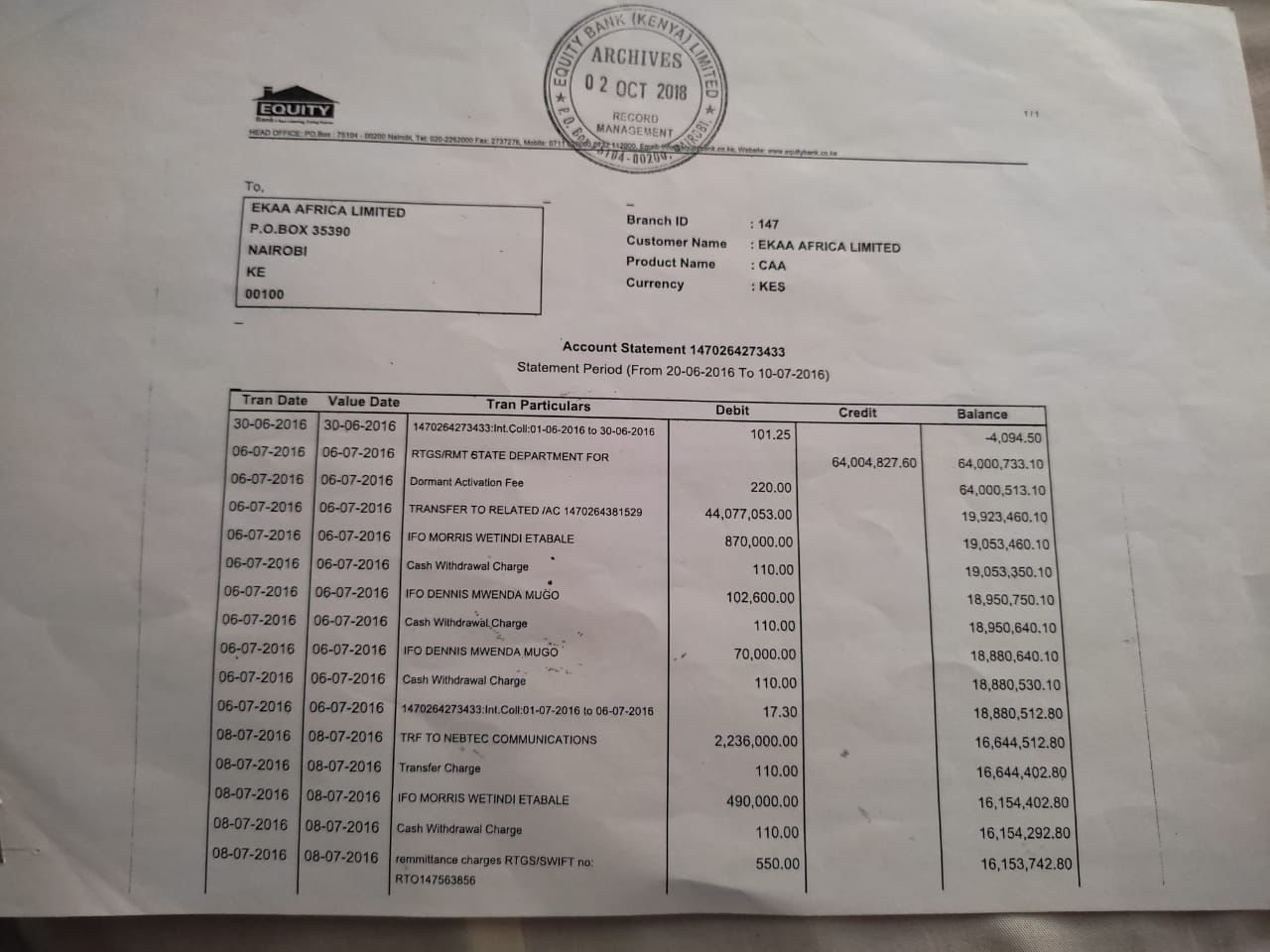

On 06/7/2016, Sh64 million was sent to that account, the same day, Sh44 million left the account. The financier agent called me asking about the transfer to Equity, I told him I am not aware of the equity account,

I went to see the manager at Equity bank Supreme Milimani branch, but he was hostile to me, that I don’t have an account with them, but I asked how was Ekaa account opened at this branch.

READ: Equitel: The Weakest Link In Equity Bank’s System, Conmen Are Having A Field Day

He refused to talk.

I left because I didn’t have any evidence. But we secured a court order to freeze the account.

The financier went to court to sue the company for fraud. I signed an affidavit to prove to the court that we were financed by James, and we opened an account at Standard Chartered bank, not Equity.

The case ended last year in August, the other directors were told to pay James back his money, that’s when I came across the official bank documents that were used to open the bank account. Equity bank shared it with the court. It is then that I realized Equity bank played a very big role in the scam, all my documents were forged.

I lost my money or my share, I lost my reputation, I lost all the business that James was supposed to fund,

2 months ago I approached

Equity but they have gone silent, I have all the evidence. Equity fueled the scam through top management, I have written to banking supervision at the Central Bank of Kenya, they are too slow to take action,

I have written to DPP through my lawyer and I’m waiting for the response.

I am taking equity bank as responsible for the whole scam, I am also taking them to civil court because they don’t want to cooperate.

If you check the date the account was opened I was not in the country.

I left the country on 21/4/2015 exit and come back on I come back on 04/9/2015.

The account was opened on 04/06/2015

Cnyakundi.com asks, how many other clients have faced similar issues?

Is the Central Bank of Kenya (CBK) aware of this fraud?