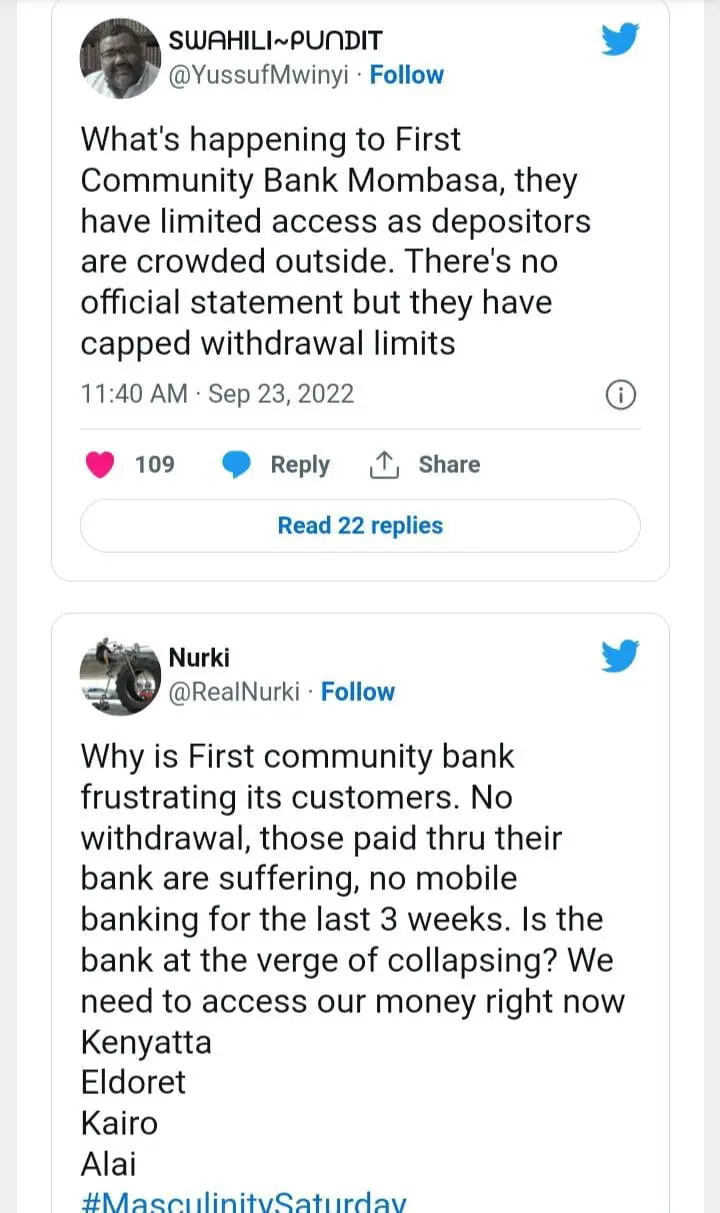

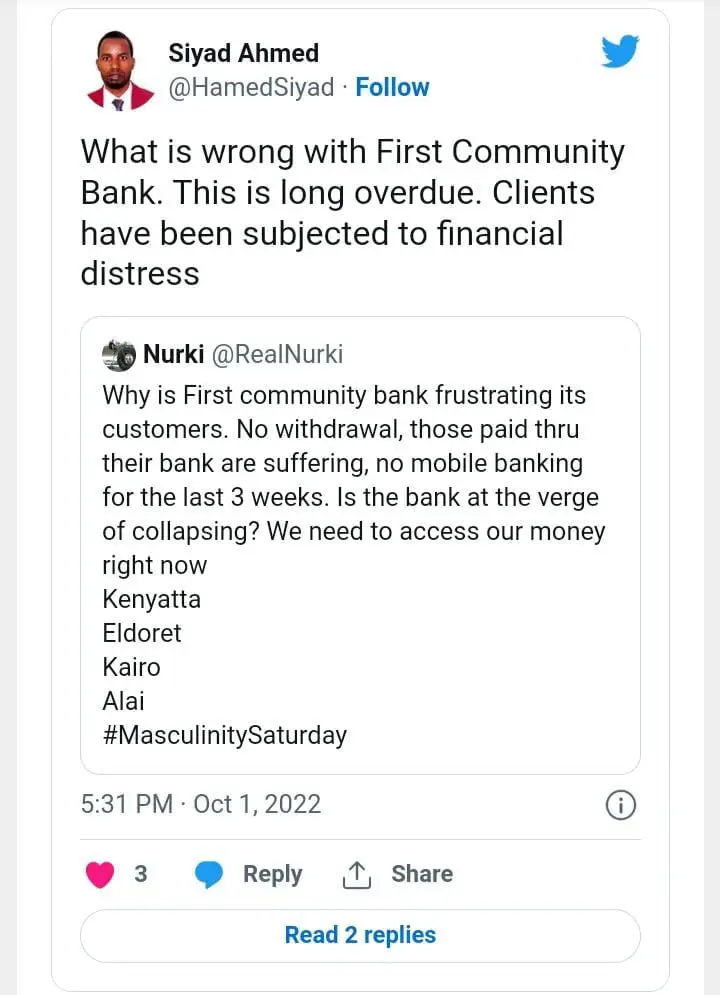

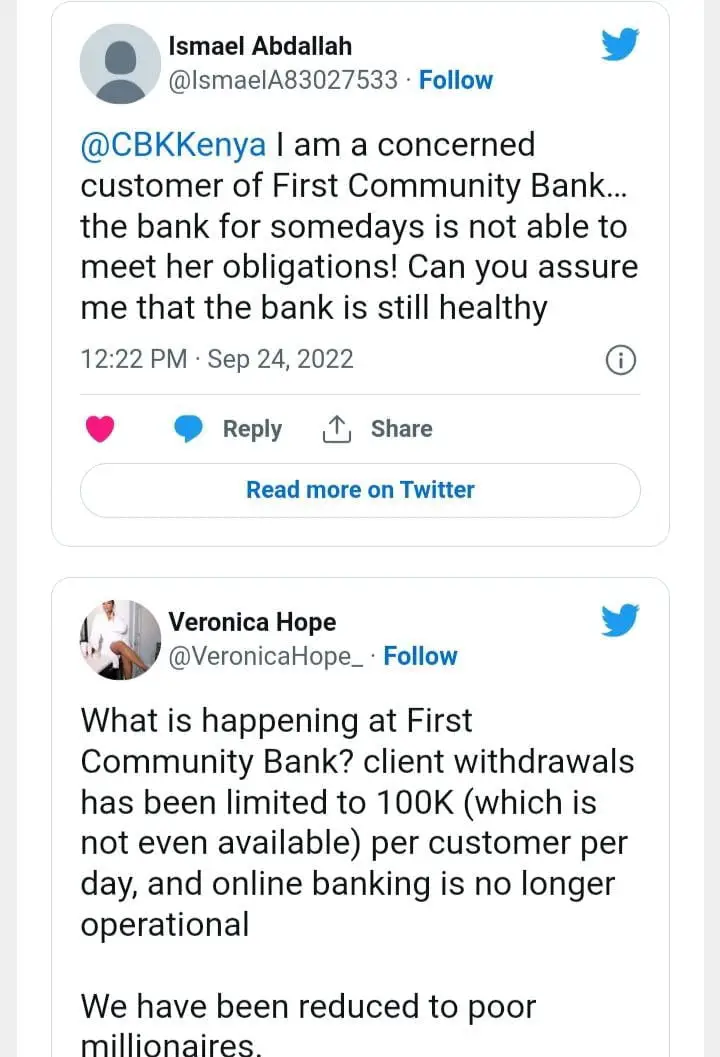

Clients of First Community Bank are a worried lot after allegations spread online that the bank has capped cash withdrawals at Sh100,000.

Some clients even say that access to that capped amount is a problem.

The bank had in late September denied the allegations calling them ‘rumours originating from malicious sources’.

However, the ‘rumours’ as they call it has persisted into October and appear true.

Worldwide there’s strong evidence that the financial systems are not okay owing to the effects of the COVID-19 pandemic, US – Russia war, and the US irresponsible printing of dollars to cushion their citizens.

The bad move has also happened in Kenya and has created massive inflation. Figures from the National Treasury and the Central Bank of Kenya are cooked to keep the fear down.

In the case of First Community Bank, years of money laundering, and pyramid scheme depositing and lending seem to have finally caught up with the bank.

It appears that insider trading and lending by directors, dependence on criminal cash to run commonly known as ‘wash wash’, that retired DCI boss George Kinoti had dismantled have brought the bank down to its knees.

Credible sources say the US govt is interested in the ‘wash wash’ networks and that George Kinoti, who sat at the Interpol Executive Committee dealt such gangs a blow.

To some, the happenings at First Community Bank is bringing bad memories of Chase Bank and others that have collapsed.

Below are some of the tweets