Despite the much publicity and fuss upon his arrival and Investments in Kenya, highlighted with the acquisition of Sumac Microfinance Bank shareholding, acquisition of Wazito FC culminating in a fancy bus launch at Windsor Golf and Country Club, fancy rides and party(s) at carnivore; the Swede has silently been disposing his assets and proceeds from Kenya in what points to an exit strategy from the country.

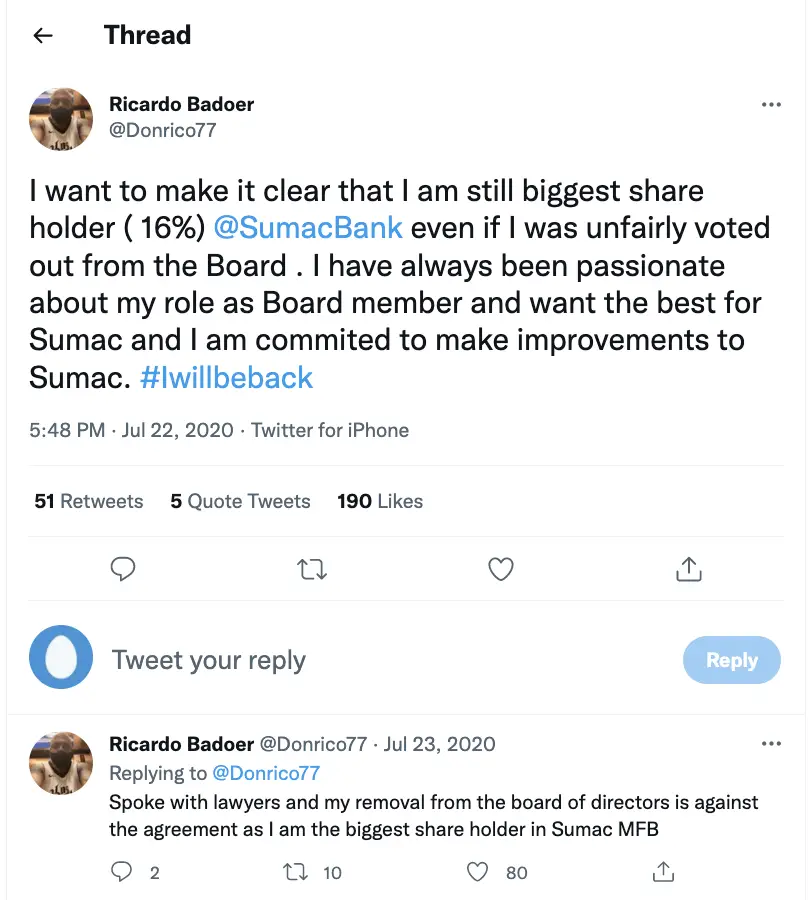

He has proceeded to sell his shareholding in Sumac Microfinance Bank where he reliably held significant shareholding at time of purchase. Reliable information point to a fallout where he was voted out as a Director, this is per his own admission where he claimed to have been removed unfairly

Given the fanfare and media publicity at the time of acquisition (https://www.google.com/amp/s/www.businessdailyafrica.com/bd/markets/market-news/dubai-based-badoer-buys-sh100m-stake-in-kenyan-sme-lender-sumac-2212606%3fview=htmlamp), it is rather remarkable the silent nature of his exit and sale of his Sumac Microfinance Bank shares from himself or the bank.

On his Twitter account (@Donrico77), the Sumac Microfinance Bank shareholding has been removed and the only left is his shareholding and Directorship at Mwanga Hakika Microfinance Bank (@mhbbank) in Tanzania.

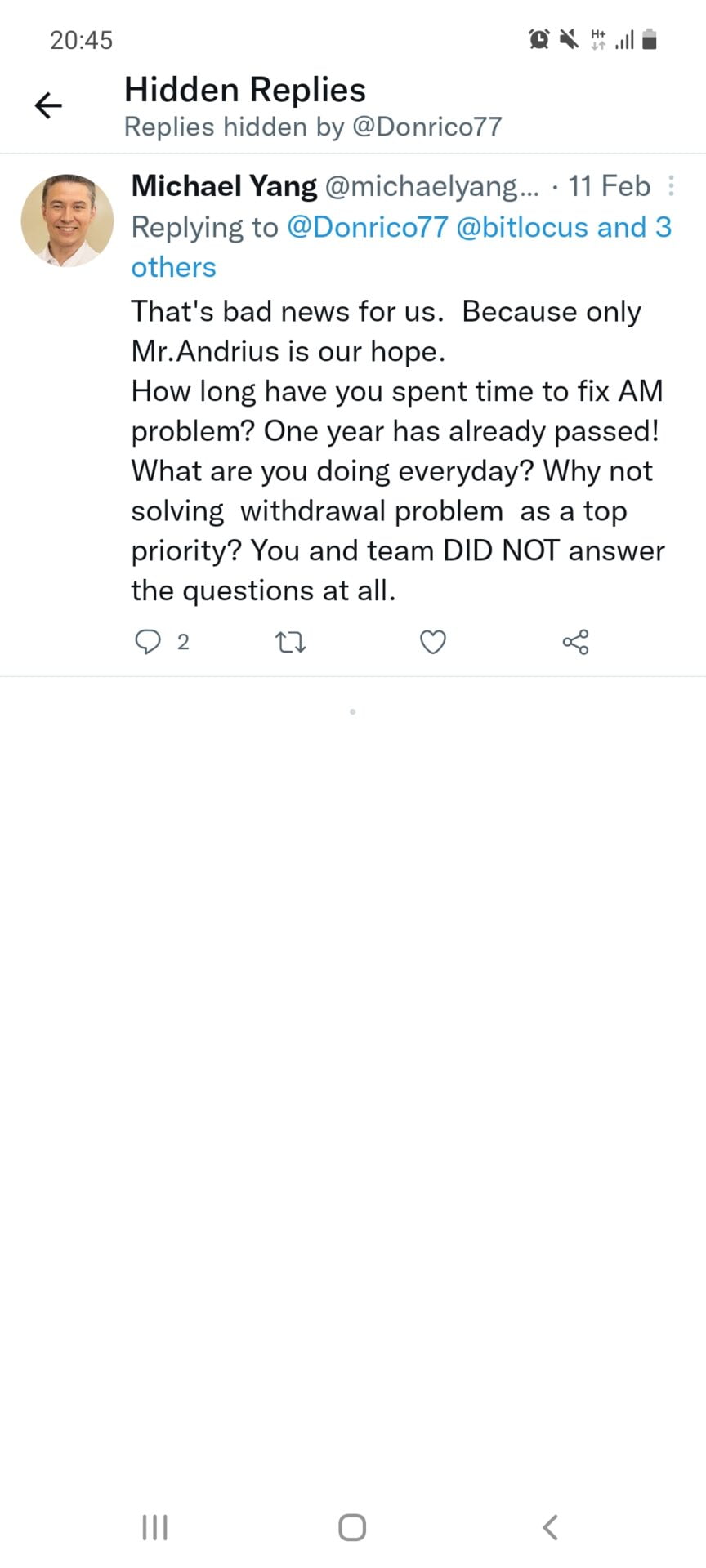

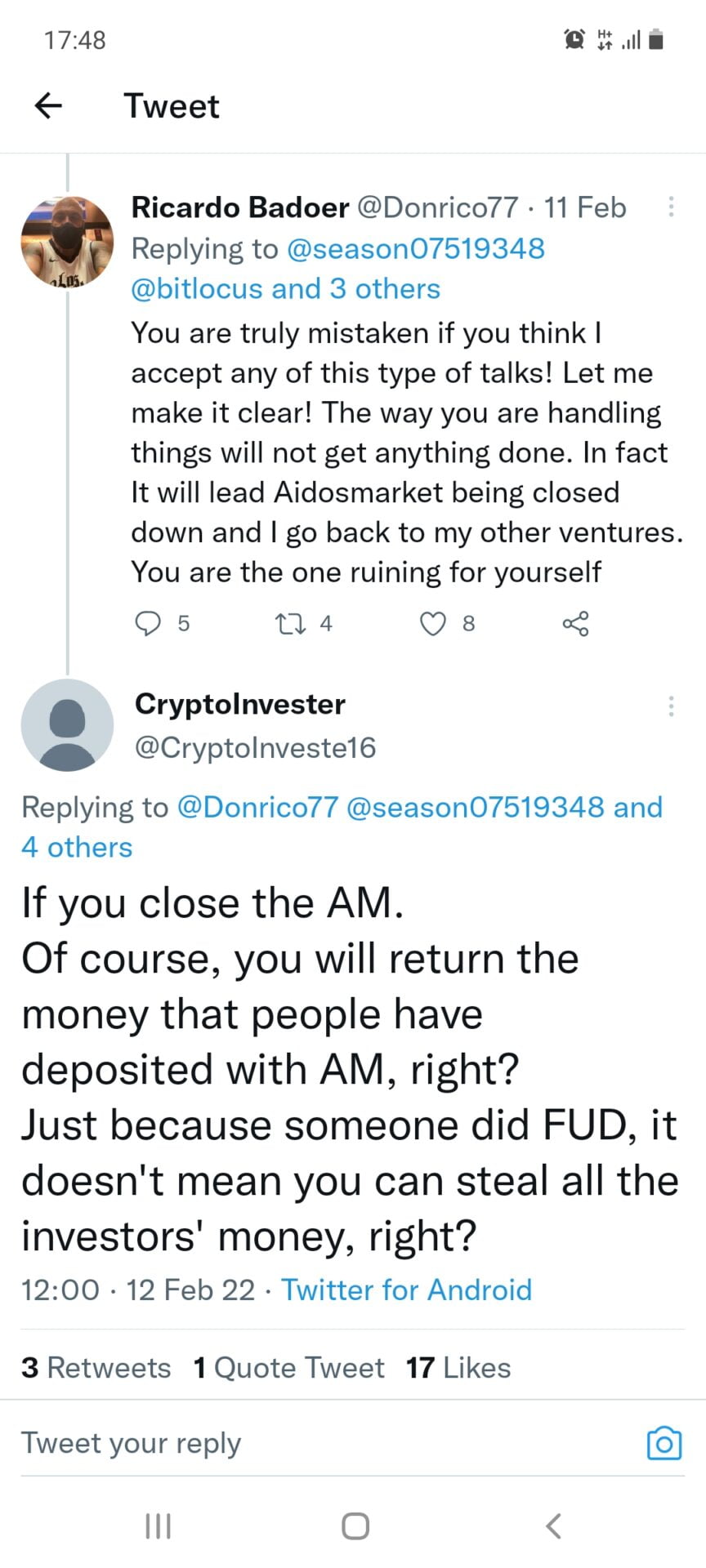

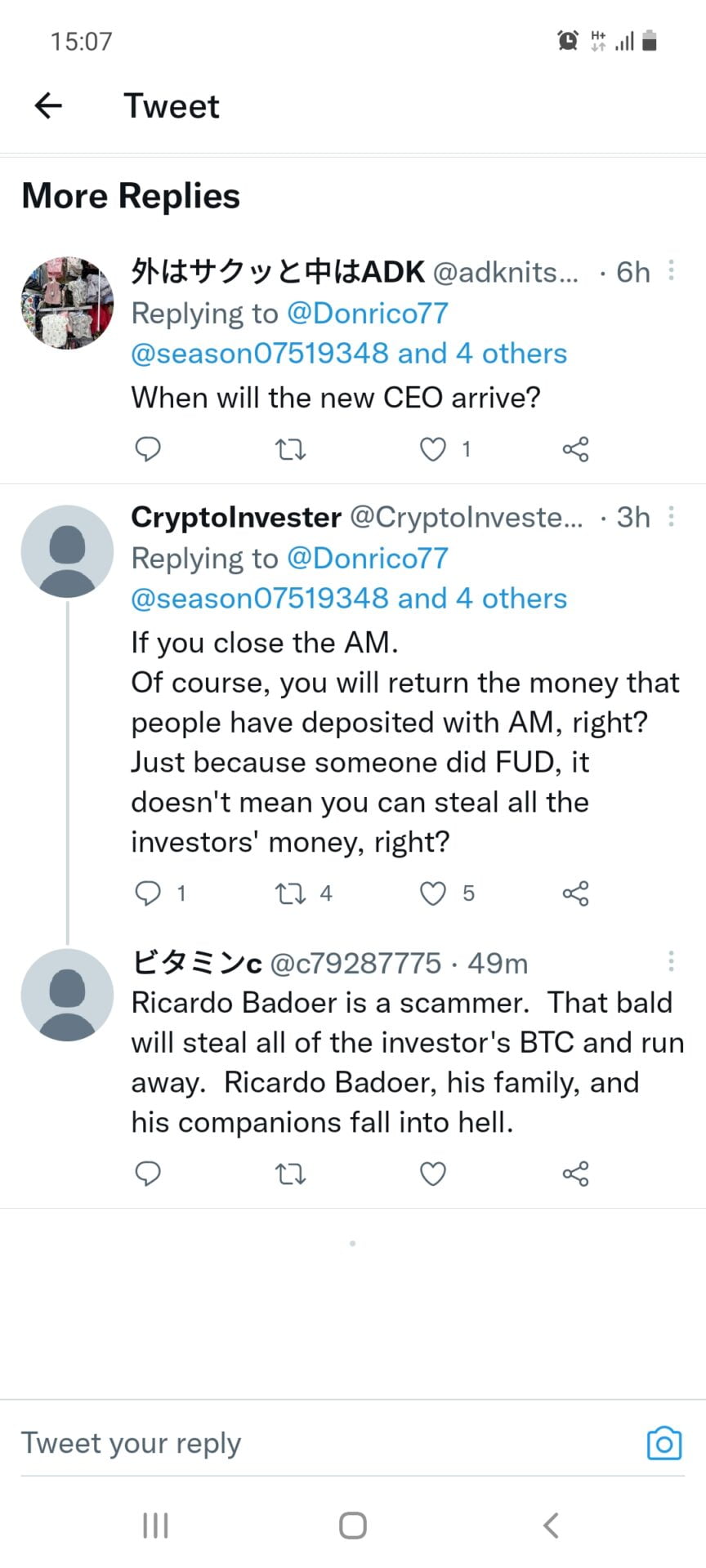

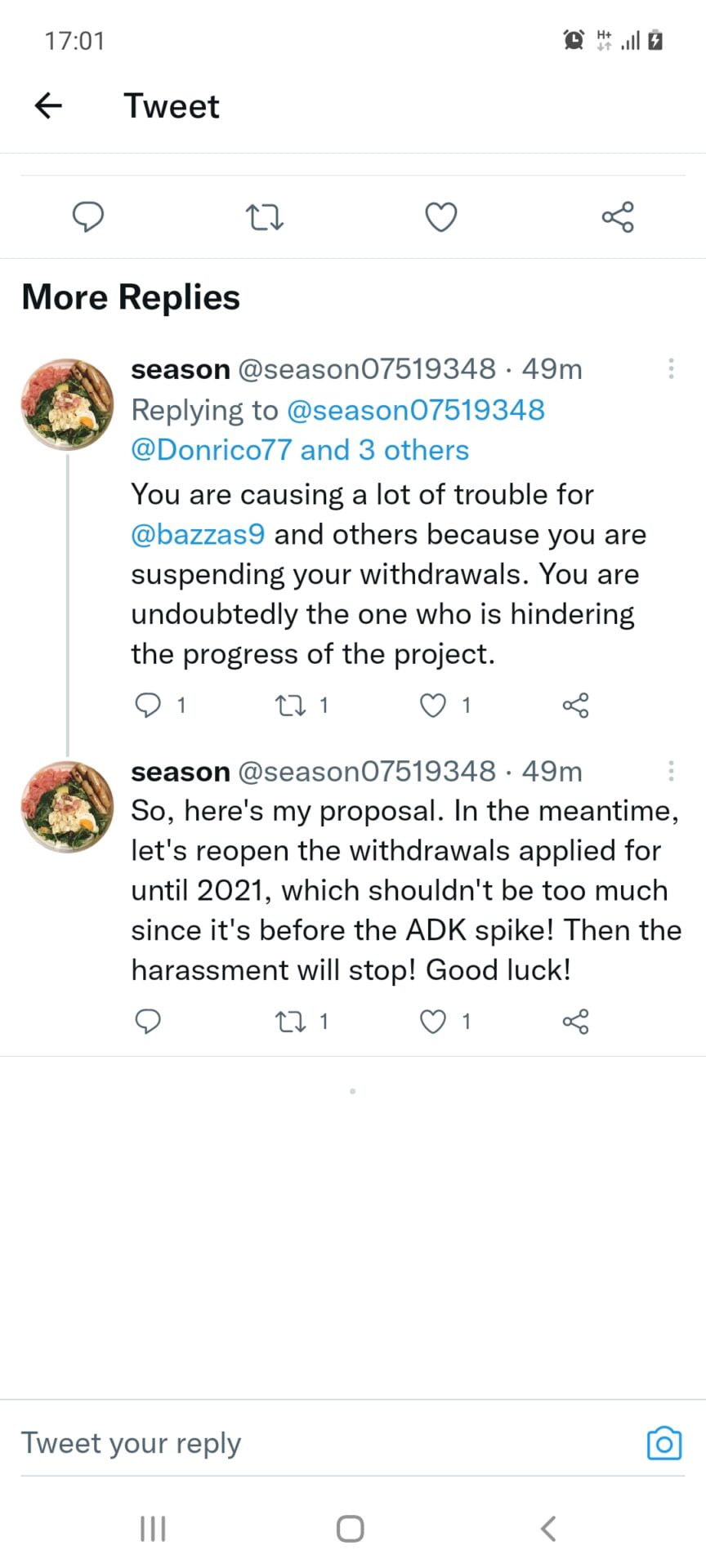

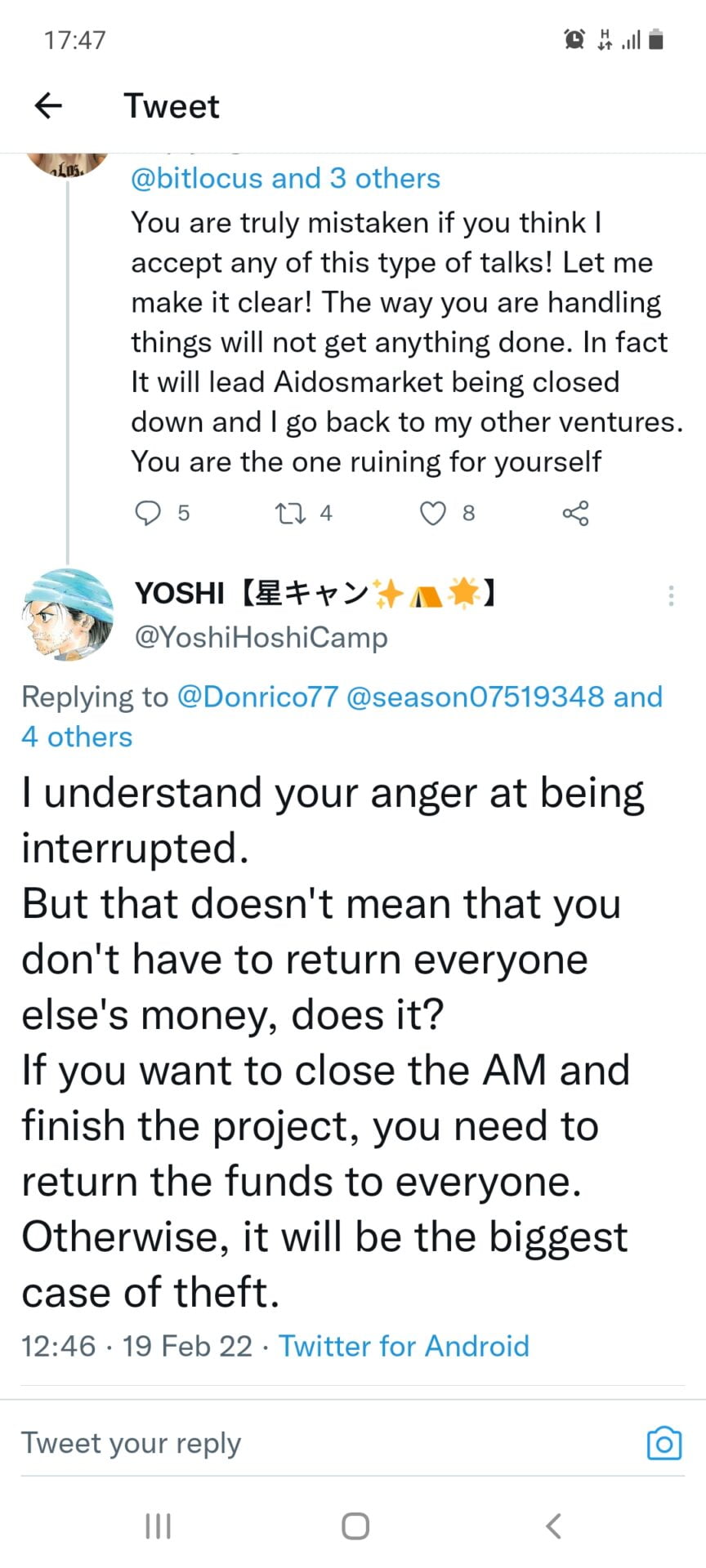

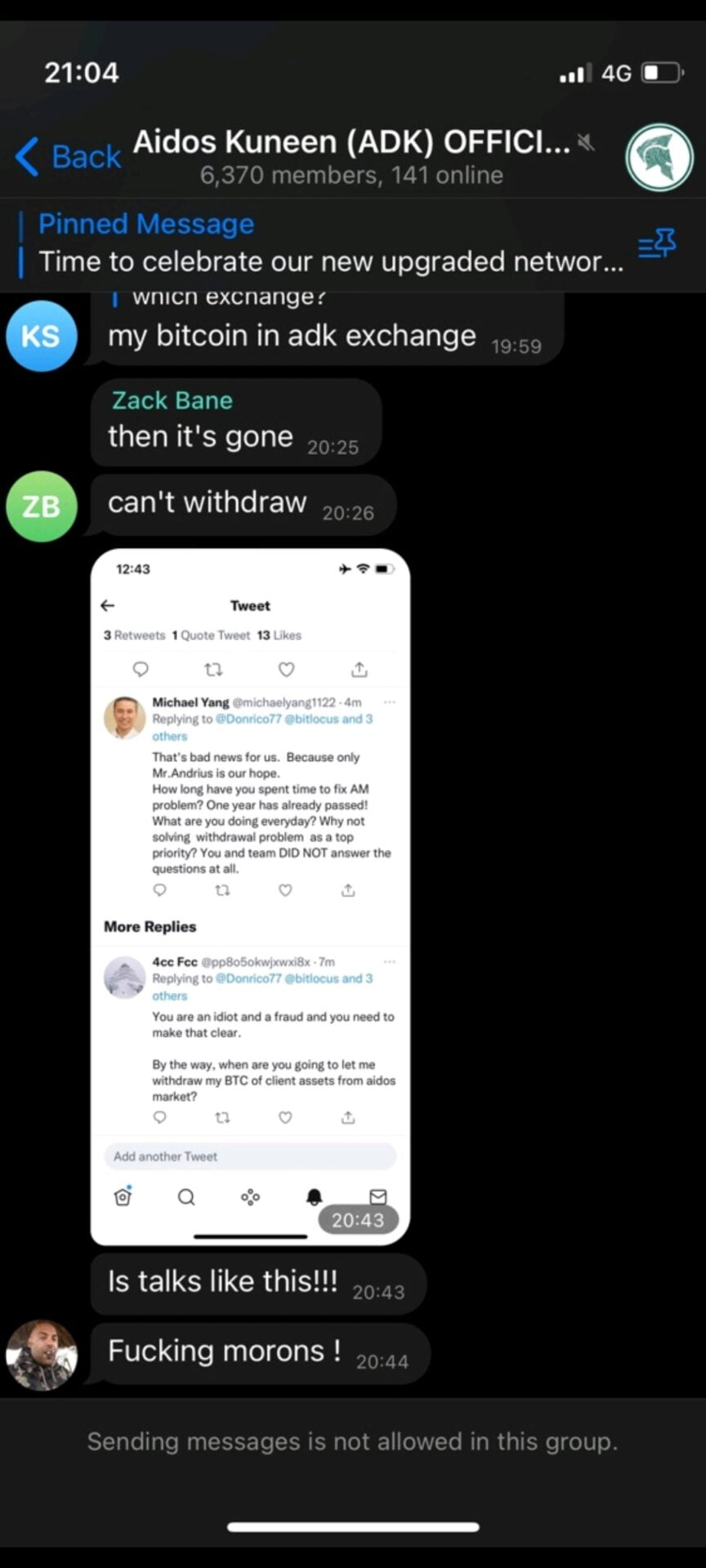

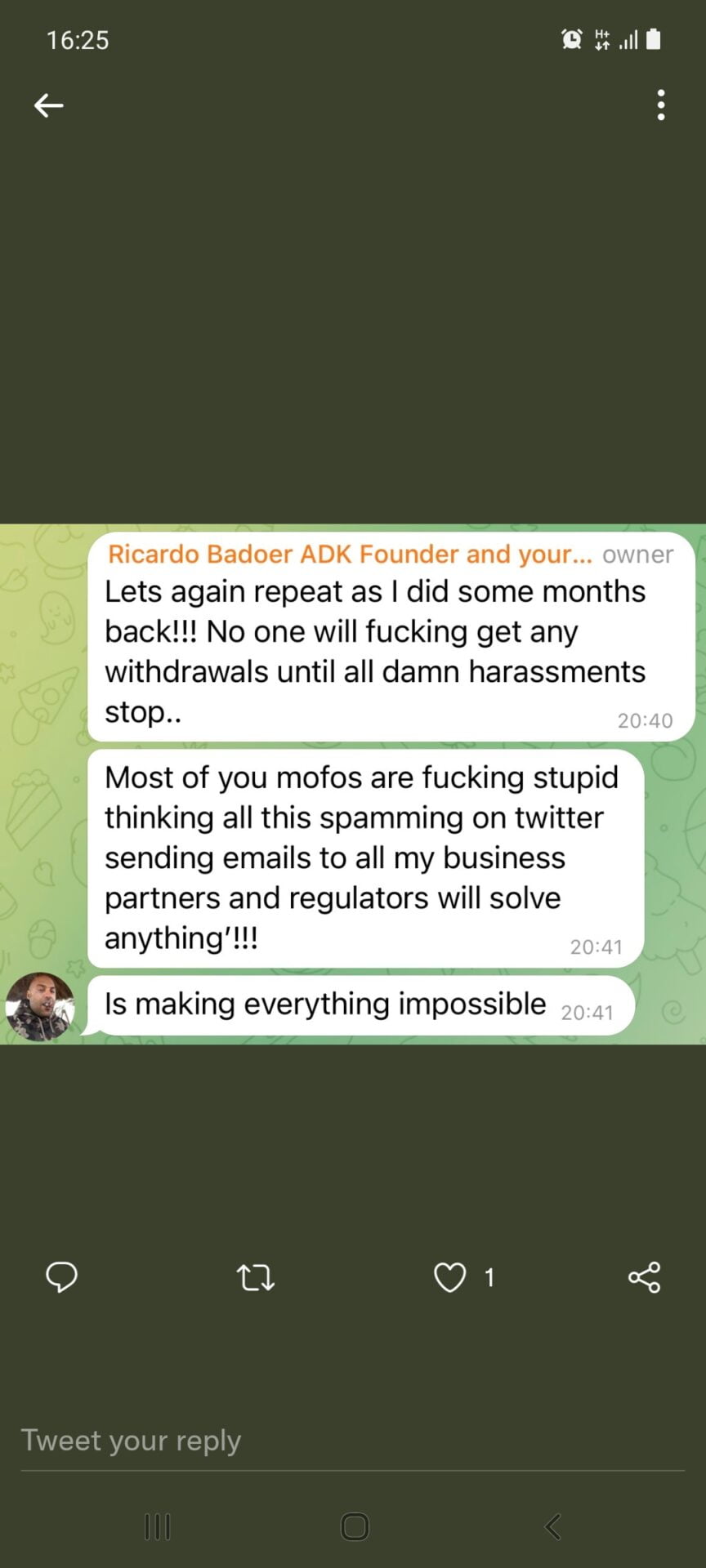

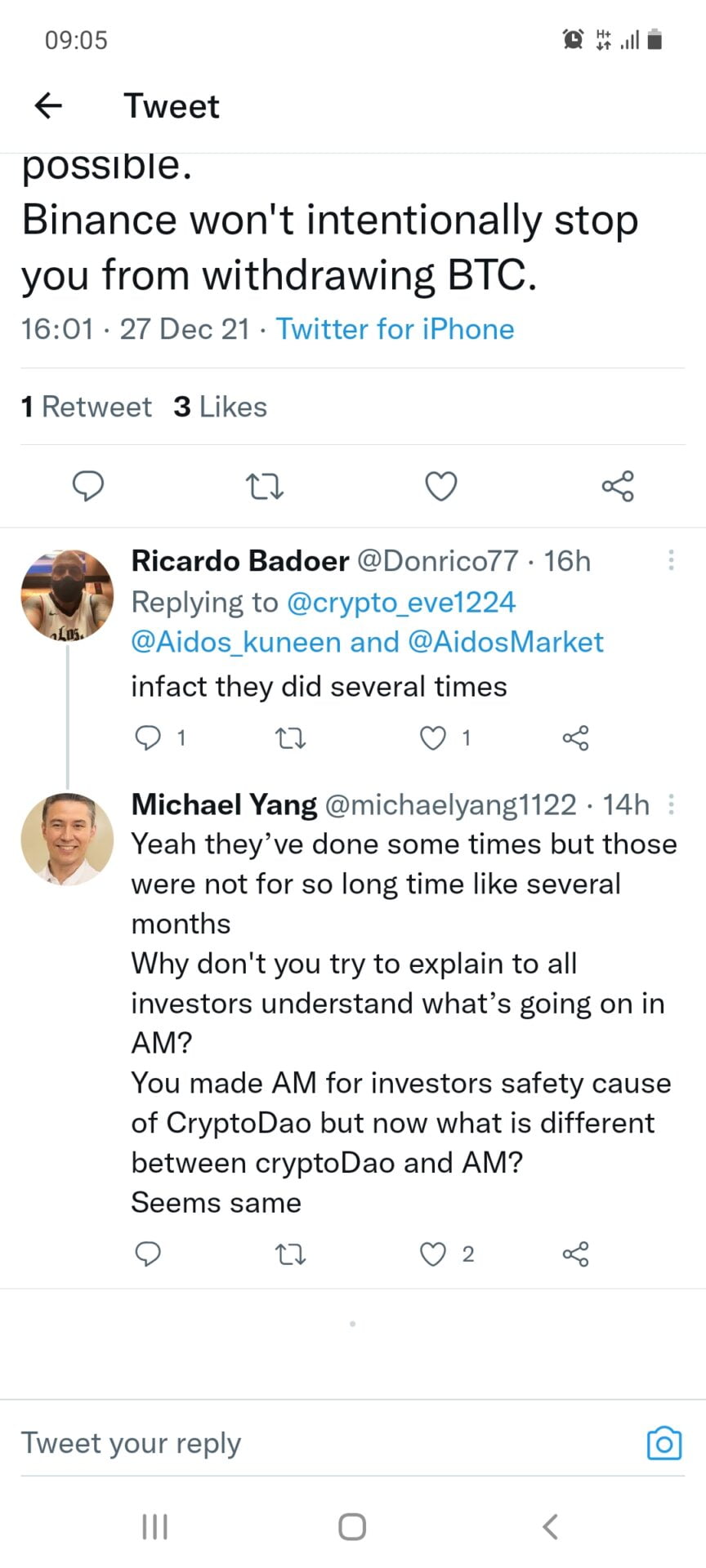

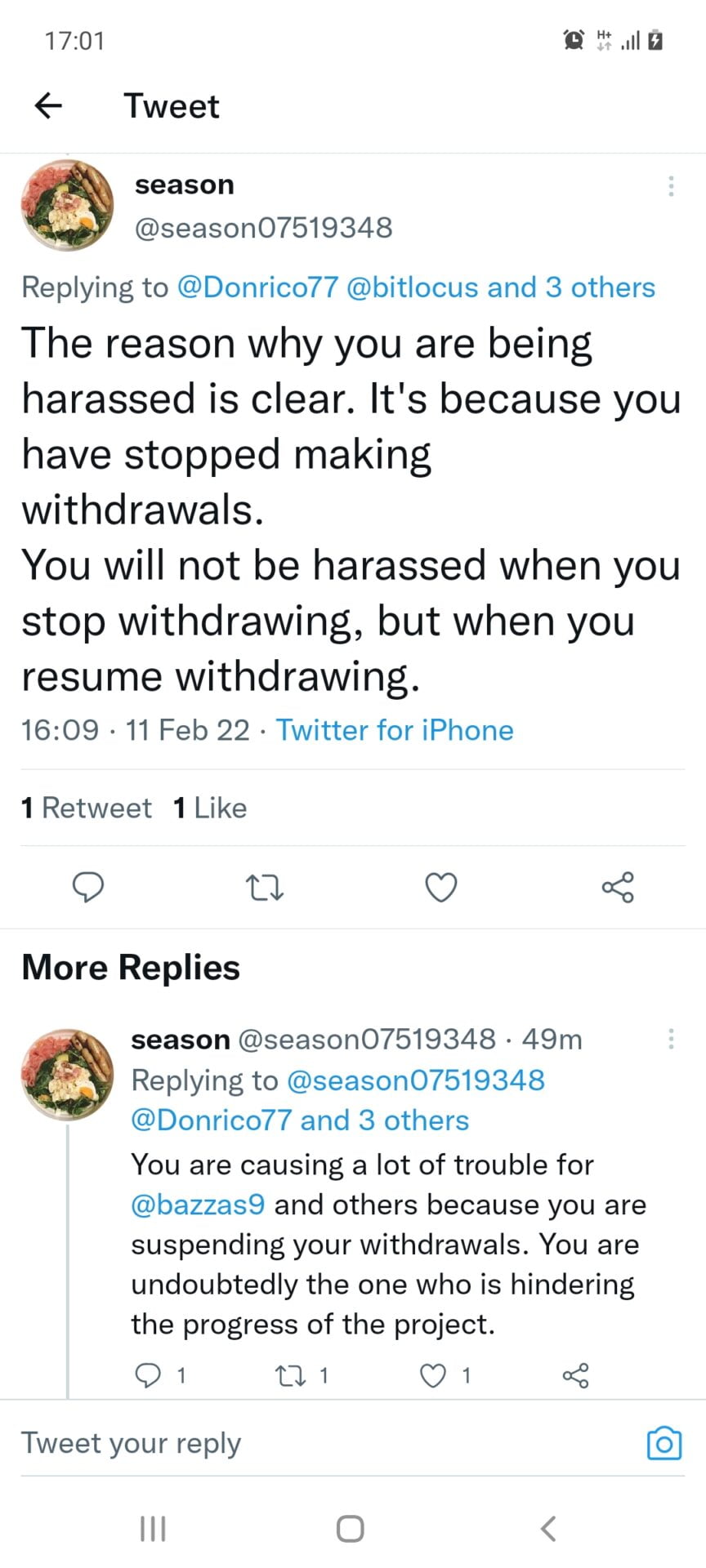

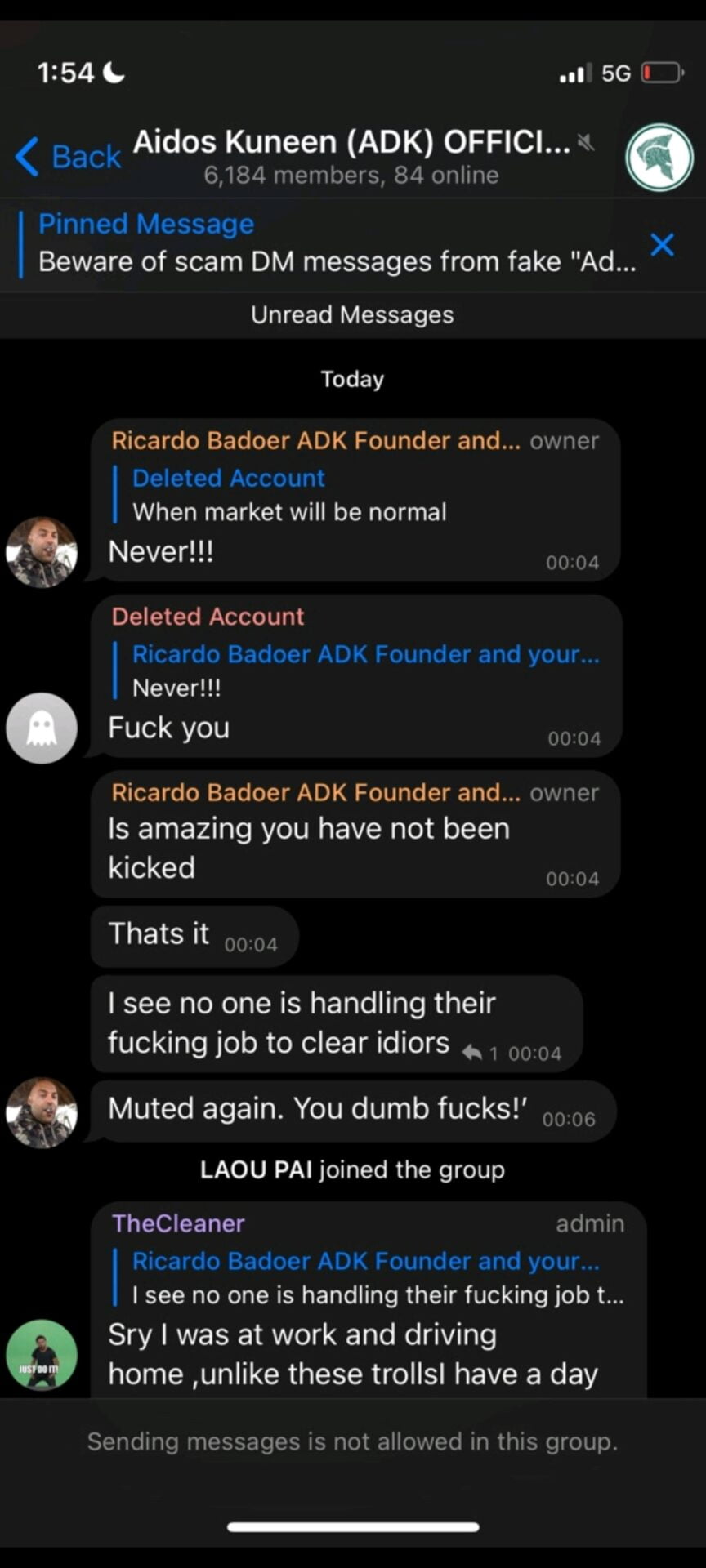

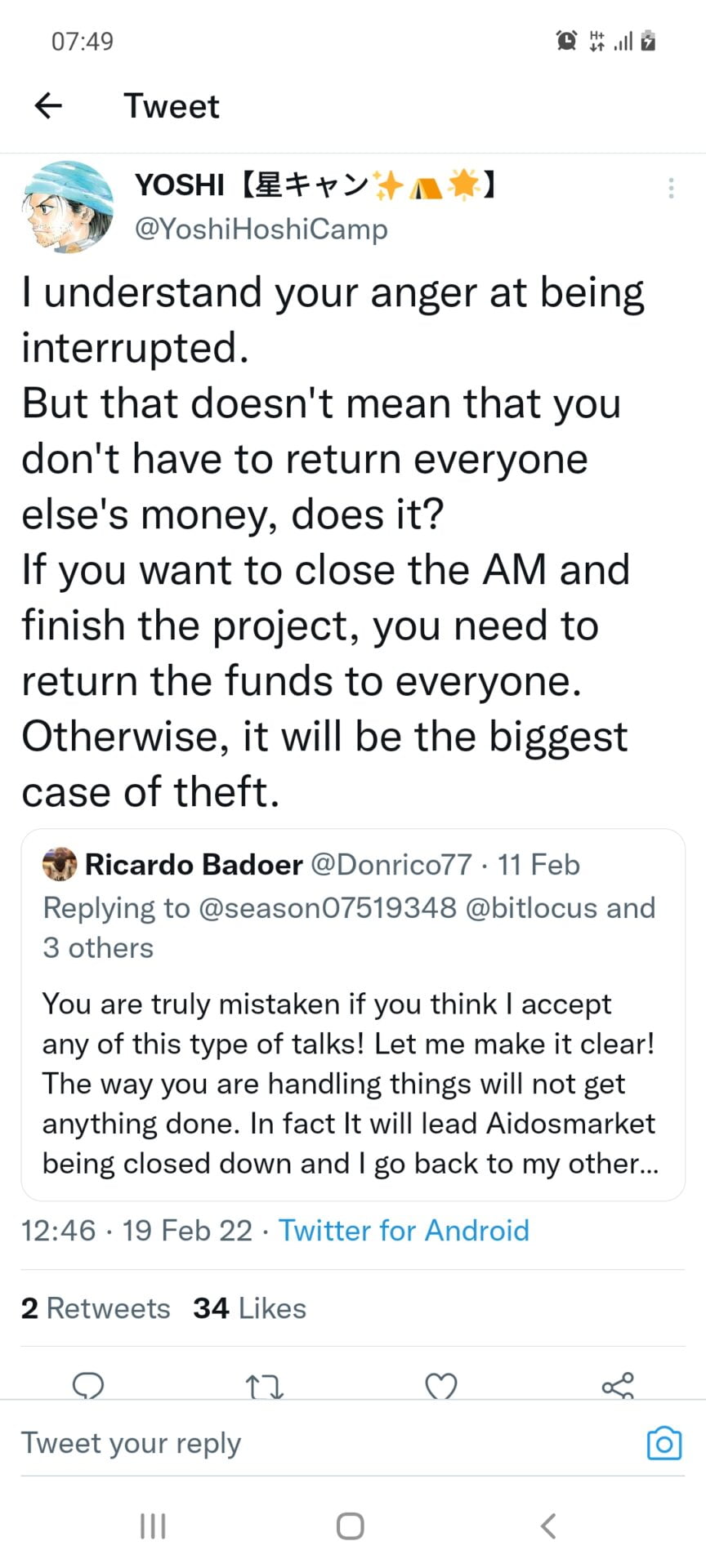

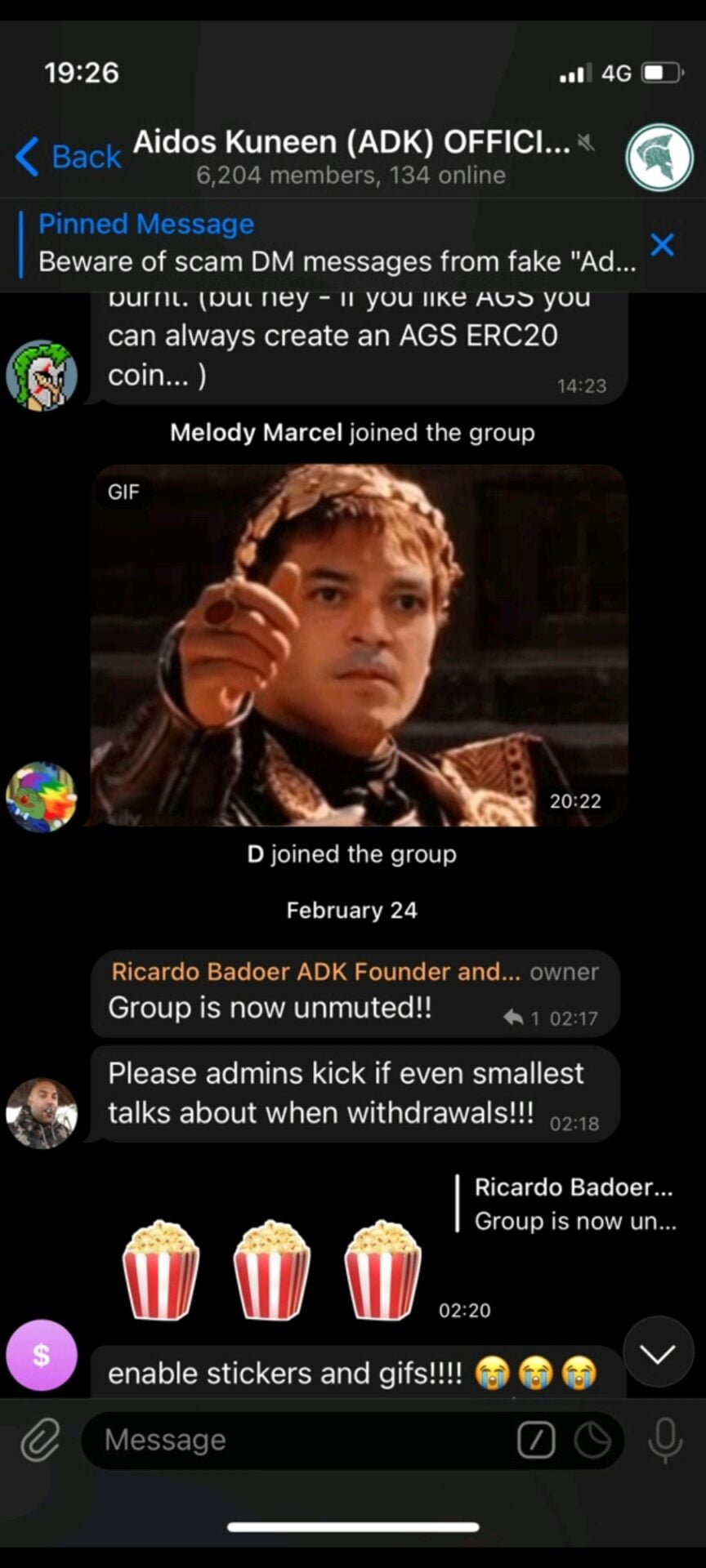

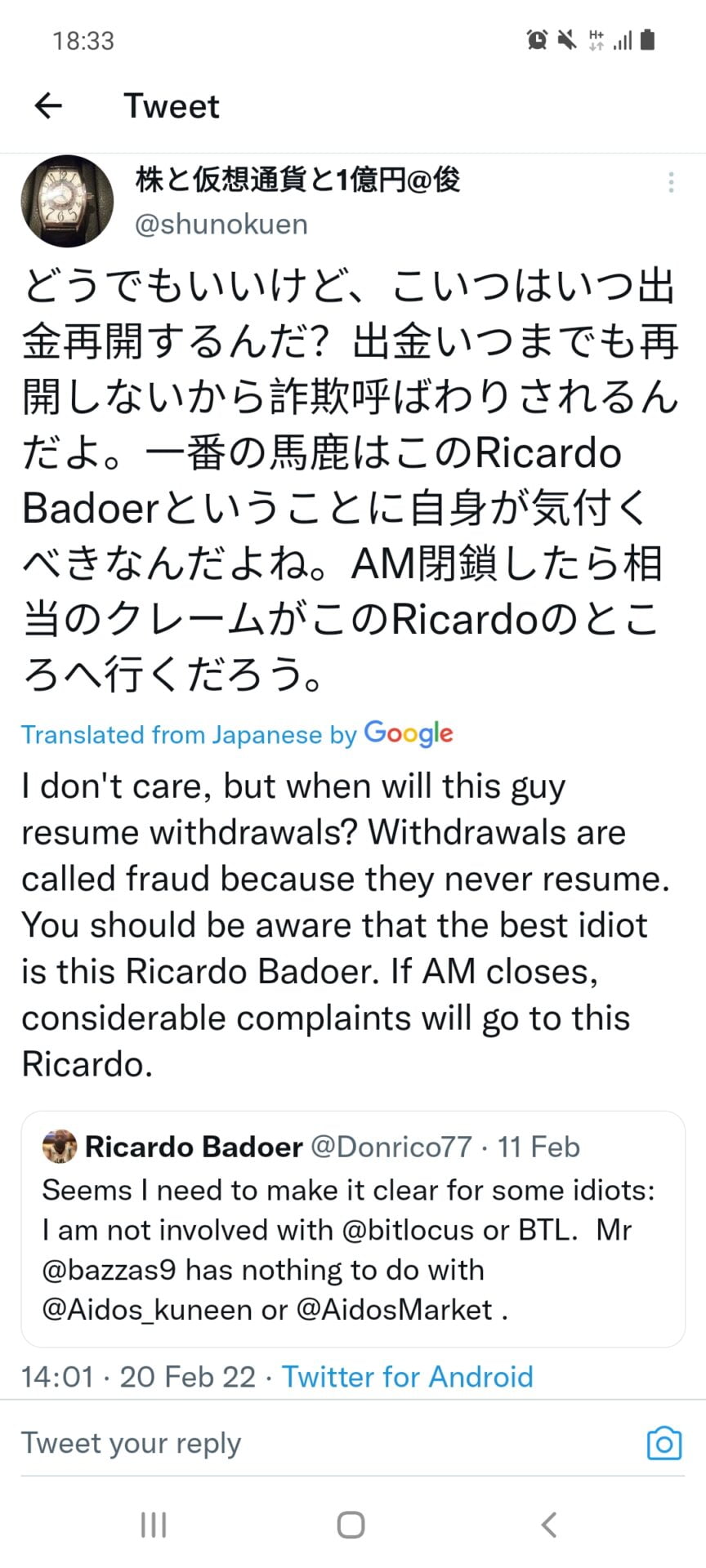

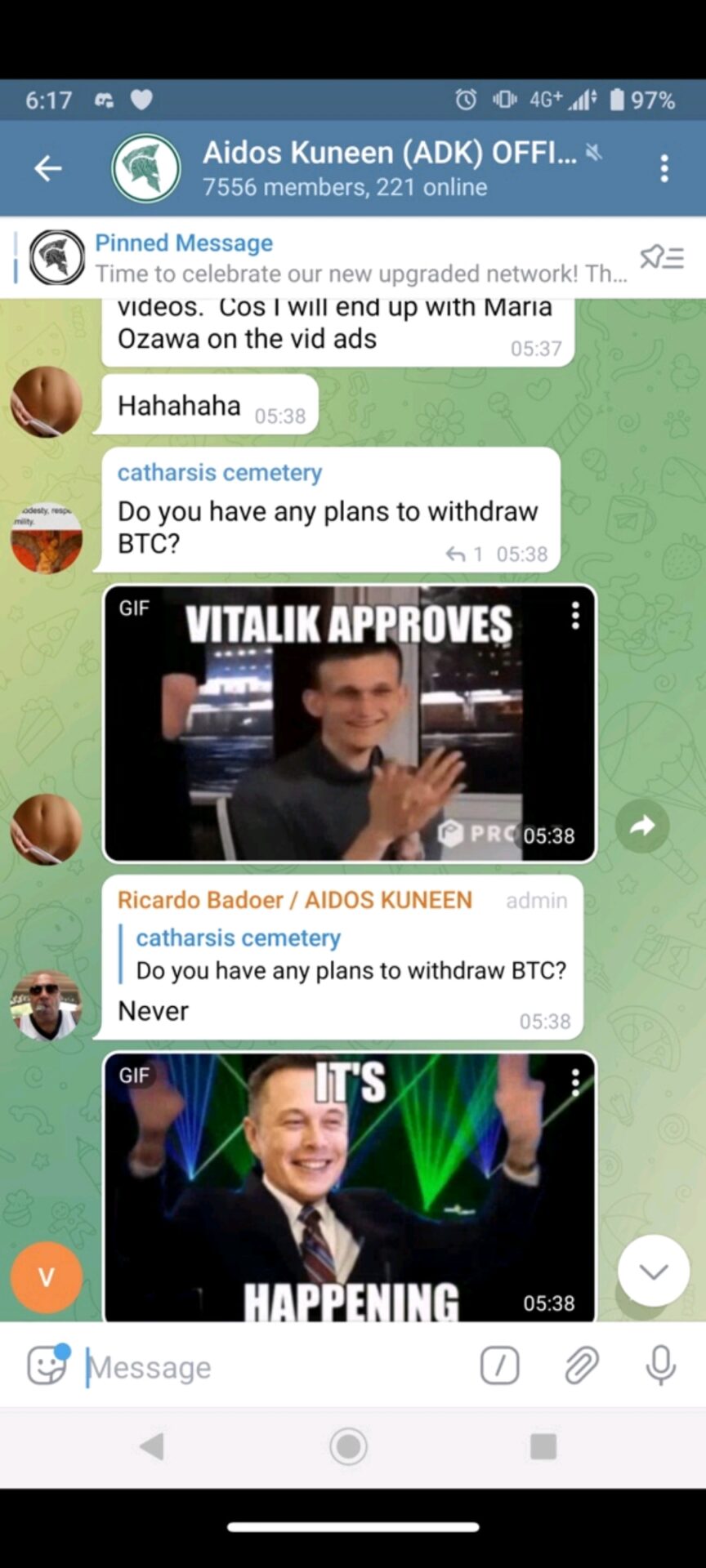

The tycoon has been under pressure from his investors through Aidos Kuneen (ADK) cryptocurrency and Aidos Market (AM) crypto exchange with rampant fraud and withheld investor funds allegations on social media from the investors (a sample few Attached).

These coupled with the poor performance of his business ventures including the media division namely Madgoat Television which has since folded and also poor results from Wazito FC in general have inflicted a heavy toll on him and depressed the crypto market (https://coinmarketcap.com/currencies/aidos-kuneen/).

Just recently, Ricardo Badoer managed to pay players and staff arrears that had accumulated over several months. The Swede has had little activity of late on his social media platforms where he used to be very active and hurled unprintable words to the staff, associates and fans who did not agree with him.

Recently, the High Court ruled and froze his assets and any bank accounts he may be holding within the Jurisdiction of the Court (True copy Attached – earlier order issued on 24th had clerical/typing errors).

Loading...

Loading...

It is worth noting that the Central Bank of Kenya in a circular to all banks and Microfinance institutions warned the banks against dealing with entities involved in cryptocurrency (Attached).

Loading...

Loading...