Hours after this blog published a disturbing story regarding the predatory practices of Momentum Credit, more innocent victims of the long-running scam have gathered the courage to speak out.

They accuse the loan shark, which operates in the heart of Nairobi, of scamming desperate individuals who turn to them for financial assistance.

On Friday, a man shared his experience of seeking a loan of Ksh400,000 from Momentum Credit.

He sadly revealed that despite initially borrowing a relatively small sum, he ended up paying over Ksh600,000 due to inflated interest rates and hidden fees.

Momentum Credit: How Predatory Loan Shark Scammed Gullible Victim

But he’s not alone.

Another victim has come forward with his own horror story of dealing with the rogue lender.

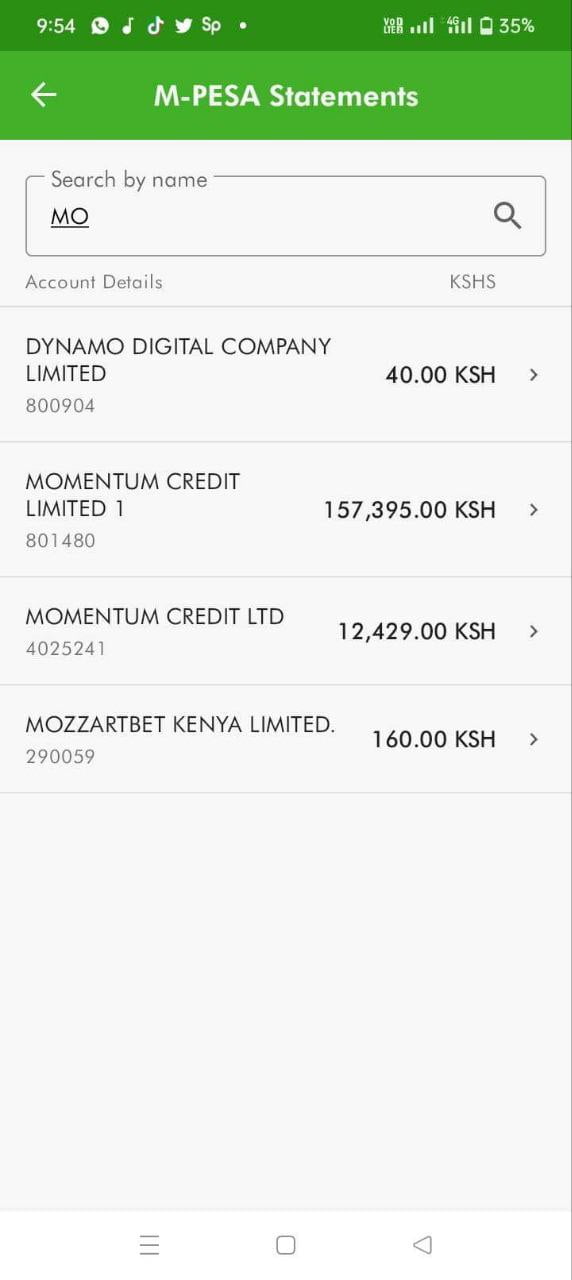

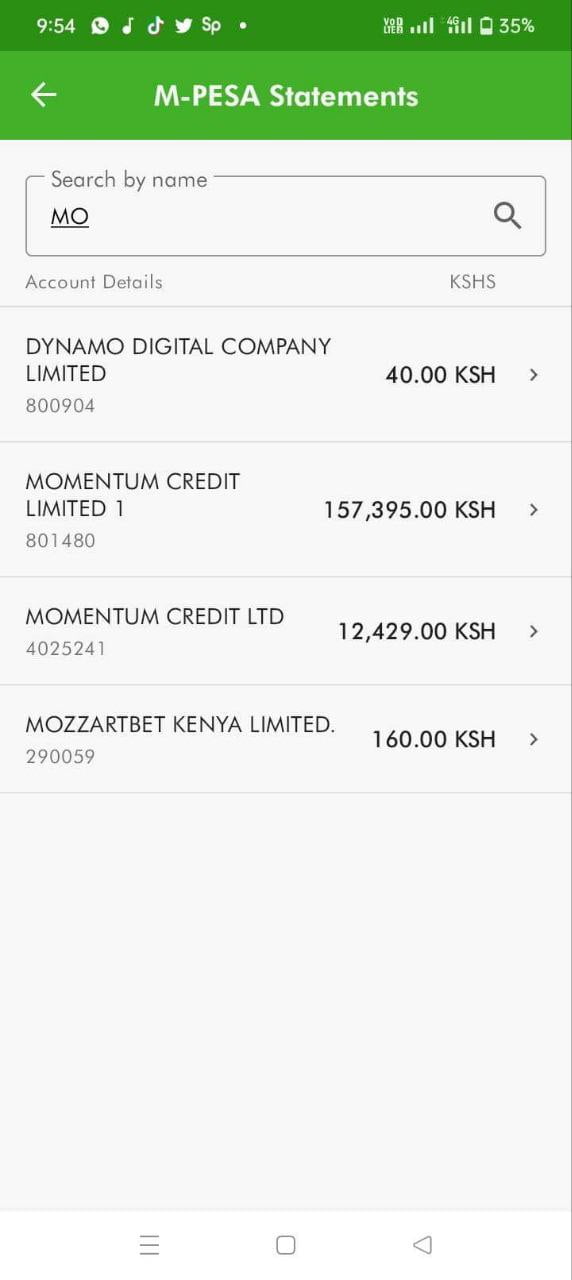

Writing us on Saturday, he narrated how he approached them in 2020 for a Ksh205,000 loan and was still paying it off two years later.

As of January 2023, he has already forked over a mind-blowing Ksh521,000.

Here is where it gets even more outrageous: whenever he requests to pay off the outstanding balance in full, Momentum Credit quotes the original Ksh205,000 figure from 2020, excluding the amount he has already repaid.

They insist he should pay as per what the statement says.

“Hello Cyprian, I have the same issue with Momentum Credit. I took a loan of Sh205k I have paid for almost two years. Whenever I want to pay off they just send me a payoff of Sh205k from 2020 up to now,” he lamented.

“When you complain about it they always tell you to pay the amount as per statement. I have paid almost Sh600k as at January 2023. I have statements from 2020. This is just 1 line from 2021 to 2022. These guys are thieves. I have paid Sh521k as at now.”

It is truly disheartening to hear of such predatory practices, preying on vulnerable individuals who are simply trying to make ends meet.

The insistence on quoting the original loan amount and ignoring the substantial sum already repaid only furthers the sense of injustice meted upon these victims.

It is clear that Momentum Credit is preying on desperate Kenyans and exploiting them for their own financial gain.

Don’t be a victim of their deceitful tactics.

If you or someone you know has dealt with this predatory lender, speak out and share your story.

Together, we can put a stop to their fraudulent behavior.