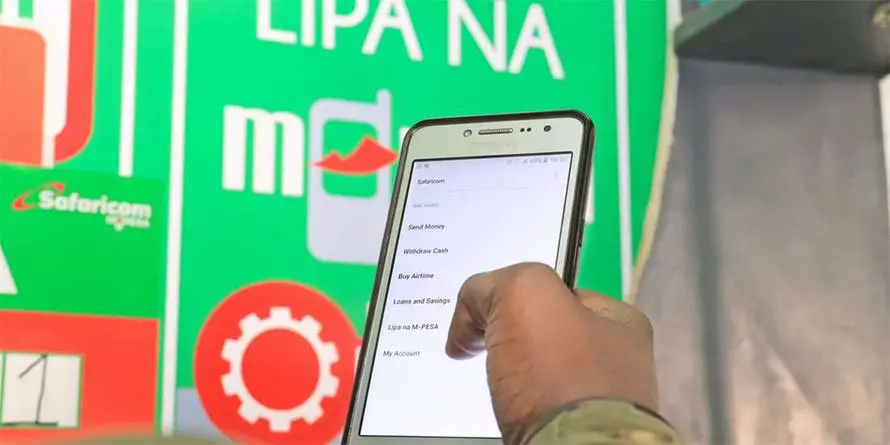

Today, MPESA, Safaricom’s revolutionary money transfer service is celebrating 15 years since its inception.

MPESA has brought joy and pain to many Kenyans and people across the world, no doubt.

Launched in March 2007, the money transfer service now has a mobile APP.

Here is the hidden history of MPESA

High cost

MPESA saved time and cost of sending money by replacing the mechanism (Post Bank, Posta and Western Union etc) which were there when it first launched in 2007.

But though MPESA saved the time within with someone can transfer money from one place to another, it steadily came under sharp focus for non-fair practices.

After years of making billions in profits, there’s no justification whatsoever why the fees on sending and withdrawing funds is still high.

https://twitter.com/NicoleJoean/status/1499304904699043842?s=20&t=2ZjJYi0gGrHTrGMVux9qjQ

Stagnant innovation

MPESA was praised the world over.

As innovation inside the Safaricom department stagnated, theft began in earnest.

Its origins remain shrouded in mystery and the explanation by Vodafone and Safaricom that it was founded by a White man in the UK has failed to catch on.

Many people, in the back of their heads, believe that a Kenyan shared the proposal and was swindled out of it.

What have you heard about this? Share [email protected]

In the field of swindling, there have been many instances where Safaricom has been accused of trashing Non-Disclosure Agreements and Intellectual Property rights.

That is covered in the links below.

READ: About Safaricom, a warning to Ethiopian Youths

The major thing is that even though Safaricom employs many Kenyans, many more Kenyans would be employed by smaller firms plugged into the Safaricom ecosystem, helping Safaricom become a global powerhouse. But, the methuselah leadership has been very myopic, greedy abs senile.

Innovativeness grounded to a halt at Safaricom and all that is being done is stealing Intellectual property rights, through sheer financial force, and then bribing the Judiciary to side with them.

Appalling.

Data breaches

MPESA had started well and the agents were required to keep a record of all transactions, deposit and withdrawals. However, one thing was not thought-through.

At the MPESA agent, a Safaricom client would leave a lot of information that scammers would use to swindle them. Political parties also found a huge resource where they could get the name, ID and phone numbers of people, they forcefully registered as party members.

Though it has now been corrected, the ramifications of this oversight still bite hard in some sections of the Kenyan society

Another one is the wanton sharing of customer data to third-party advertising agents by rogue Safaricom staff. People get bombarded with insane amounts of unnecessary adverts since their data is leaked online.

Thirdly, it is Safaricom, even without a proper court order, colludes with Police to hunt down and sometimes kill people who are considered dissidents.

Some people are innocent.

Fourthly, how come Safaricom did not raise suspicion on the amount of MPESA numbers that terrorists that bombed DusitD2 had registered?

As M-PESA celebrates 15 years, we at cnyakundi.com continue to be impartial in our reporting of the excesses of the monopoly Safaricom. The with huge financial reach as to bribe the mainstream media and hire influencers online to shut down important conversations concerning its excesses and ills.

Today, you can be a lone voice while condemning a murder that happened due to Safaricom data breach or a business idea that has been swindled out of the hands of the inventor by Safaricom managers.

The Judiciary, security services will also join in the silence.

If you doubt me, just ask Kibo Capital Group Limited, Anyona Obutu, Gee K Muri, Faulu Bank, Jacob Juma and George Muchai families.

As you read about MPESA, these are some of the things the PR will not talk about.

There’s more.

Mpesa is expensive than.

— Karim (@gideorlah) February 4, 2020

1. SimbaPay

2. Neteller

3. PayPal

4. Skrill

5. WorldRemit

6. PesaLink

7. Western Union

8. Wave

9. OFX

10. Bank

11. Cash

12. XendPay

13. Xoom

14. Money Gram

15. Payoneer

16. Chippercash

17. Zelle

18. TransferWise

And Many More